June 2, 2023

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way…” – Charles Dickens, A Tale of Two Cities

The opening sentence to Dickens’ classic tale of paradox seems an appropriate comparison to the financial markets this year, particularly the month of May, for a few reasons.

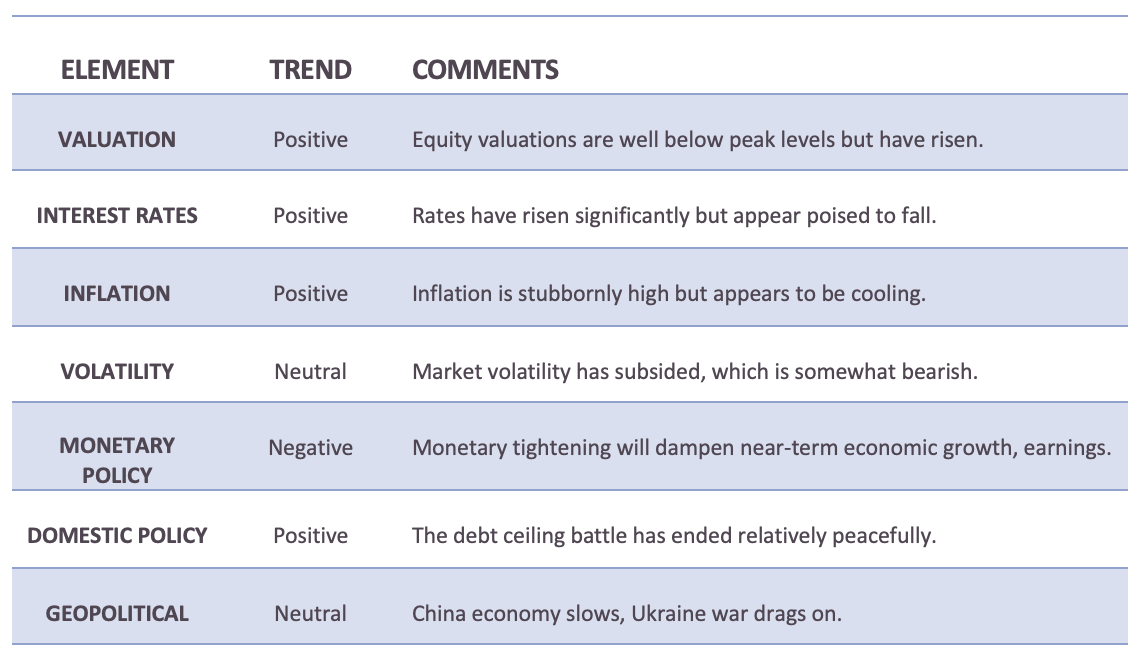

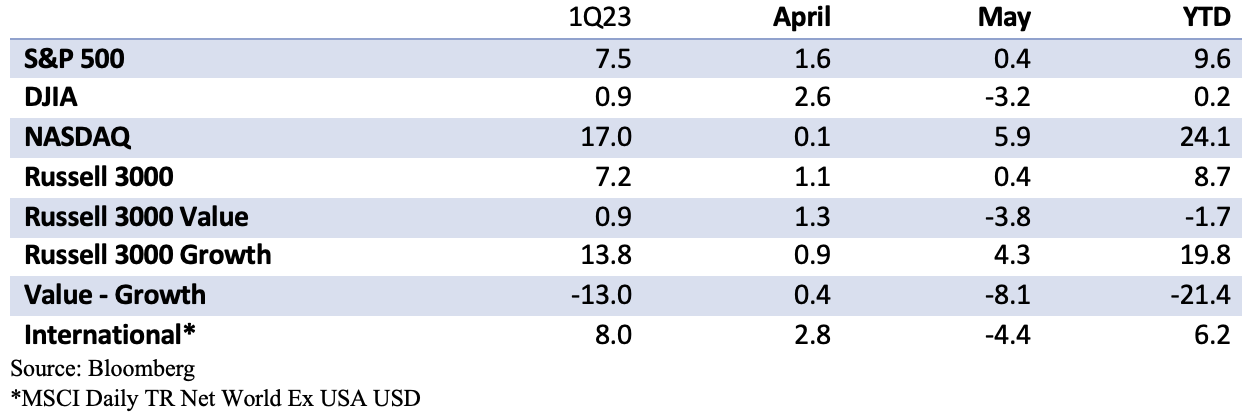

The first reason is not really new news, but it underscores a fundamental truth about financial markets. Paradoxically, markets require reasons to worry in order to advance. This year, we have experienced a minor financial crisis, continuing inflation, fear about a coming recession and predictions of a sovereign debt default. Meanwhile, through the end of May, the S&P 500 returned 9.6%, and the NASDAQ returned 24.1%. Markets discount new developments quickly.

The perception of bad news or emerging risks should be viewed as a temporary condition that will eventually fade and be reevaluated by the market with a revised price. This process of constantly adjusting to new information is why we prefer volatile markets to calm markets for new investment. As fears of a U.S. debt default have dissolved this week, markets have leaped higher, which is great for existing investors, but less so for potential investors whose expected future returns are actually diminished slightly by rising current valuations. Still, all else equal, diversified investors have reason to be pleased with the performance so far this year.

The second reason this Dickens novel comes to mind is that, although it is true that most major indices have seen an overall rise this year, the performance has been quite uneven. While the S&P 500 and the NASDAQ have leaped higher, the Dow Jones, with its stodgier components, was down more than 3% in May and is barely positive for the year. For tech investors, especially those with a hint of interest in artificial intelligence or “AI” exposure, it has been a tale of a wonderful city indeed. The Invesco QQQ Index, which tracks the top 100 non-financial stocks in the NASDAQ, is currently up more than 33 percent year-to-date. Meanwhile, an equal-weighted basket of all the companies in the S&P 500 is actually slightly negative for the year.

Virtually all of the market’s advance has been concentrated in a top handful of stocks. While it is normal for the top ten or so stocks to represent a disproportionate amount of the S&P 500’s total value, the index is unusually concentrated at the moment, with five stocks representing about 25 percent of the index’s total value: Apple, Microsoft, Amazon, Nvidia and Alphabet. Beyond this group, performance has been much more muted. This lack of breadth paints a less sanguine portrait of the overall financial markets. It truly has been a tale of excess at the top and growing envy and unrest festering beneath the surface. Growth stocks, which were practically left for dead after last year’s rout, have come roaring back.

Although growth has historically lagged behind value since the start of 2022 when markets experienced a decline due to rising interest rates, growth has significantly narrowed the gap. Perhaps it is not a coincidence that this growth rally has occurred as the Fed appears prepared to pause its rate-hike campaign.

Our third reason for quoting A Tale Of Two Cities is… to acknowledge our new AI overlords. According to the news headlines, writers, teachers, coders and financial analysts alike are among those professionals who face a more difficult future. One day in the not-so-distant future, towering achievements, such as A Tale of Two Cities, apparently will be churned out in seconds, and certainly articles such as this will be written by bots. The weather outside is lovely – approximately 82 degrees Fahrenheit – exactly one degree warmer than average here in North Carolina. Here in North Carolina, the state flower is the dogwood and the state dog in North Carolina is the Plott hound. I hope you have a pleasant weekend. It was lovely chatting with you – bye.

For more information, please reach out to:

Burke Koonce III

Investment Strategist

bkoonce@trustcompanyofthesouth.com

Daniel L. Tolomay, CFA

Chief Investment Officer

dtolomay@trustcompanyofthesouth.com

This communication is for informational purposes only and should not be used for any other purpose, as it does not constitute a recommendation or solicitation of the purchase or sale of any security or of any investment services. Some information referenced in this memo is generated by independent, third parties that are believed but not guaranteed to be reliable. Opinions expressed herein are subject to change without notice. These materials are not intended to be tax or legal advice, and readers are encouraged to consult with their own legal, tax, and investment advisors before implementing any financial strategy.