Taking A Breather

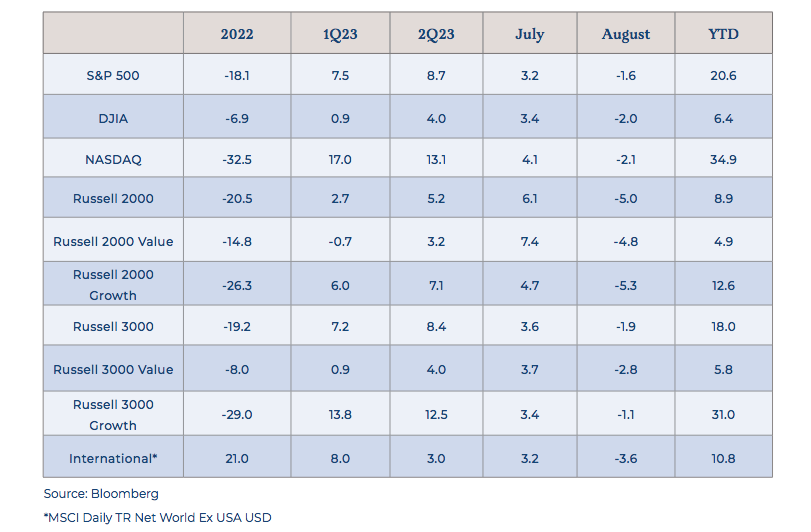

Markets were modestly lower in August, with all major indices declining somewhat. The S&P 500 was 1.6% lower, the Dow Jones fell 2% and the NASDAQ dropped 2.1%. Markets had been considerably lower mid-month but encouraging sentiment regarding the direction of interest rates emerged to turn markets higher again, along with solid earnings from some of the mega-cap tech names that have been driving this year’s remarkable equity market performance. Even with the pullback, the NASDAQ has returned almost 35% this year.

Aside from the slight dip, the overall characteristics of the markets remained fairly intact during August. Stocks of larger companies tended to do better than their small-cap brethren. While small-cap value stocks held up slightly better than small-cap growth during the month, growth continued to outperform value at the top end of the market.

As we touched on in last month’s letter, the excitement regarding artificial intelligence, and the economic opportunities for companies with business models that would directly benefit from AI, has fueled significant outperformance among some of the largest stocks in the financial markets. As of August 31, the top ten stocks in the S&P 500 represent 32% of the index’s total market capitalization—the highest in decades. While it’s normal for companies with great growth prospects to represent an outsized share of the index, this is a little much. Moreover, while it’s normal for the top ten stocks to trade at a premium earnings multiple (the long-term average is about 20x vs. the market’s average of 16.5x), the current price-earnings multiple on the top 10 stocks is almost 28x. There’s just no other way to say it—that’s high.

It’s doggone hard to experience favorable outcomes buying stocks at 28x earnings. The current multiple on the S&P 500 is 18.8x, which is also a little rich, but 28x? That’s stupid rich. Could multiples expand even more? Perhaps. Multiples on the top 10 stocks were slightly higher during the COVID era, but they were fueled not only by zero percent interest rates but also by traders trading in their pajamas. They were also higher in the dot-com boom (approaching 44x!), but that ended in tears.

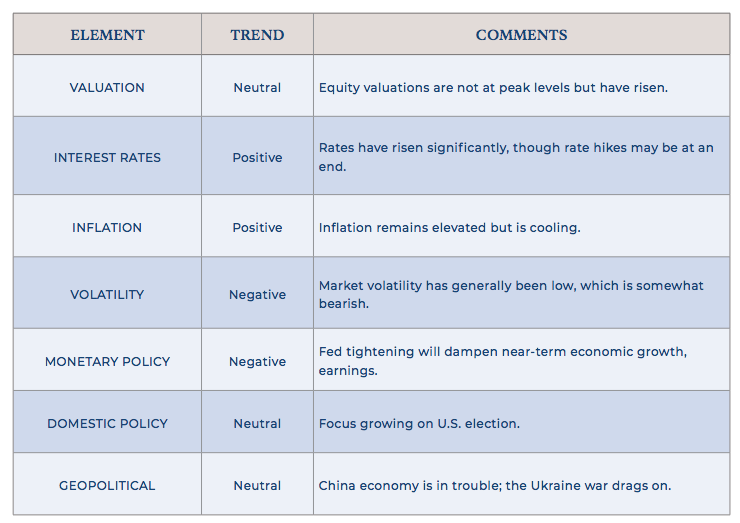

This rally has been great. Of course, rallies have a way of creating their own reality, and the world feels like a better place with a brighter future. Even so, the market reflects the current wisdom about global corporate prospects and likes what it sees. Recent economic data suggests that inflation is continuing to cool, and the white-hot labor market is even beginning to show signs of softening. These data points help bolster the case that the Fed’s rate hike campaign is ending. Moreover, the Fed Fund futures curve suggests the Fed will cut rates next spring. That suggests the economy will be weaker in a year, which happens to be an election year. Get your popcorn ready!

Of course, we are not attempting to predict the future, but rather position portfolios for the most favorable outcomes based largely on probability. AI will undoubtedly have unimaginable impacts on humanity, but it doesn’t change the fact that the probability of favorable outcomes from buying loads of stocks at 28x is low. We don’t need Chat GPT to tell us that.

Click here to download the PDF.

For more information, please reach out to:

Burke Koonce III

Investment Strategist

bkoonce@trustcompanyofthesouth.com

Daniel L. Tolomay, CFA

Chief Investment Officer

dtolomay@trustcompanyofthesouth.com

This communication is for informational purposes only and should not be used for any other purpose, as it does not constitute a recommendation or solicitation of the purchase or sale of any security or of any investment services. Some information referenced in this memo is generated by independent, third parties that are believed but not guaranteed to be reliable. Opinions expressed herein are subject to change without notice. These materials are not intended to be tax or legal advice, and readers are encouraged to consult with their own legal, tax, and investment advisors before implementing any financial strategy.