May 3, 2023

The Amazing Discounting Machine

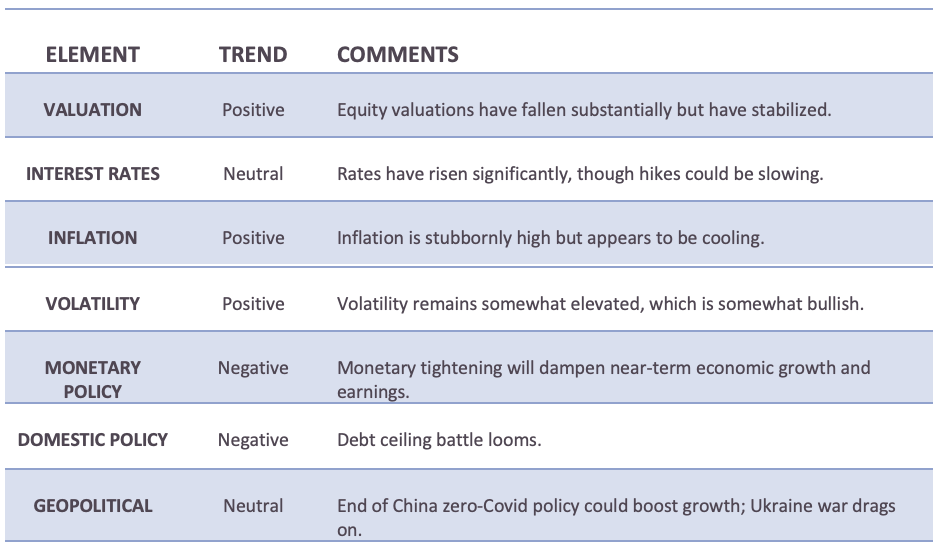

April was a month in which headlines were quite frightful. Fears about financial instability continued, and with good reason, as two large banks had failed and another was about to sold to J.P. Morgan (Silicon Valley Bank, Signature Bank and First Republic, respectively). At the heart of this financial instability, of course, are the dramatically higher interest rates introduced by the Fed over the past year that were intended to fight inflation. Each of these factors (financial instability, higher interest rates and inflation) is a legitimate concern for investors. Together, they are the formidable Cerberus. Moreover, the executive branch and the legislative branch appear to be on a collision course regarding if the United States of America will default on its debt. And yet… markets moved meaningfully higher during April. Talk about the dog that didn’t bark.

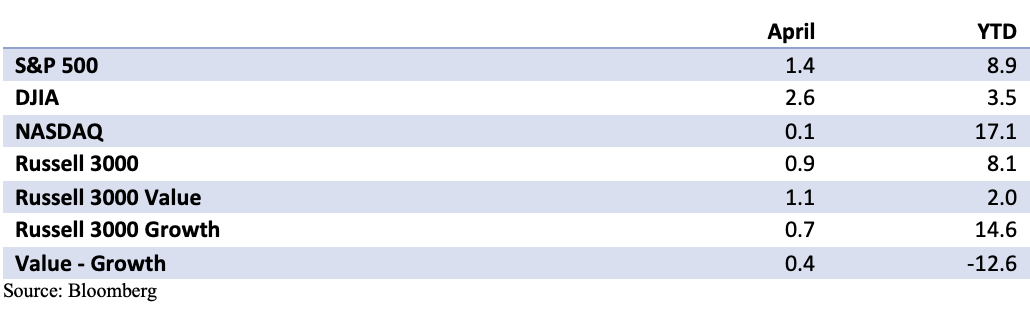

The major market indices all moved higher last month. The S&P 500 returned 1.4%, the Dow Jones climbed 2.6% and the NASDAQ squeaked out a 0.1% gain. Year-to-date through the end of April, the S&P 500 has returned 8.9%, the Dow Jones is up 3.5% and the NASDAQ, with its tech leaning, is now up 17.1%

Growth indices have outpaced value indices so far this year, and a couple of reasons come to mind. First, growth indices were far more severely washed out after last year’s bludgeoning, with the NASDAQ having finished the year down more than 32%. Some of the assets that fell the most in price last year have climbed the most so far in 2023. Second, value indices tend to be populated by financial stocks, many of which have suffered this year, owing to the aforementioned financial fears.

So, what’s behind the financial system fears? Well, it turns out that when the Fed Funds rate approaches 5% (and as of today, it is now above 5%), and most banks are paying less than that on deposits, customers begin to ask themselves why they are being asked to assume lower returns for higher risk. Just as there has been a flight to safety in the stock market this year, with mega-cap stocks, such as Meta Platforms and Microsoft outperforming, there has also been a flight to safety within the banking system. This is evident with the likes of J.P. Morgan and First Citizens reaping the rewards, snapping up weaker rivals and negotiating attractive backstop deals from regulators as a bonus.

What’s more, funding costs are not the only problem facing banks as the economy cools. As economic growth slows and much higher financing costs make their way through the system, not everybody who borrowed at 3% is going to be able to refinance at 9%. Credit problems are sure to emerge, especially in commercial real estate, where valuations are not only down because of higher rates, but also because of the quasi-permanence of remote work. Finally, the money spigots that, in recent years, funded amazing growth areas, such as venture capital, have largely been turned off. In short, it’s not just depositors moving money around that is contributing to financial instability – it’s depositors spending down cash.

Of course, we have not even really begun to focus on the non-zero chance that politicians in Washington, D.C., will be unable to negotiate a way to raise the federal debt limit in order to continue funding the U.S. government. Regardless of one’s politics, it seems a rather sad state of affairs.

So, with all these obviously legitimate reasons to be fearful, some folks have been understandably asking how is it possible that the market has advanced so strongly this year? Has the market lost its collective mind? Well, that’s a possibility, we suppose. However, it is also a possibility, in fact it is also quite likely, that many market participants have not been ignoring the Fed’s actions for the past year and have noticed these much higher funding costs. It is also not impossible that many market participants determined last November, and perhaps even well before then, that the Biden administration and the Republican Congress would eventually clash over the debt ceiling issue.

Markets are not perfectly efficient, but they are reasonably effective at pricing risk over the long term. They are amazing discounting machines. After all, if they weren’t, they would not exist very long.

For more information, please reach out to:

Burke Koonce III

Investment Strategist

bkoonce@trustcompanyofthesouth.com

Daniel L. Tolomay, CFA

Chief Investment Officer

dtolomay@trustcompanyofthesouth.com

This communication is for informational purposes only and should not be used for any other purpose, as it does not constitute a recommendation or solicitation of the purchase or sale of any security or of any investment services. Some information referenced in this memo is generated by independent, third parties that are believed but not guaranteed to be reliable. Opinions expressed herein are subject to change without notice. These materials are not intended to be tax or legal advice, and readers are encouraged to consult with their own legal, tax, and investment advisors before implementing any financial strategy.