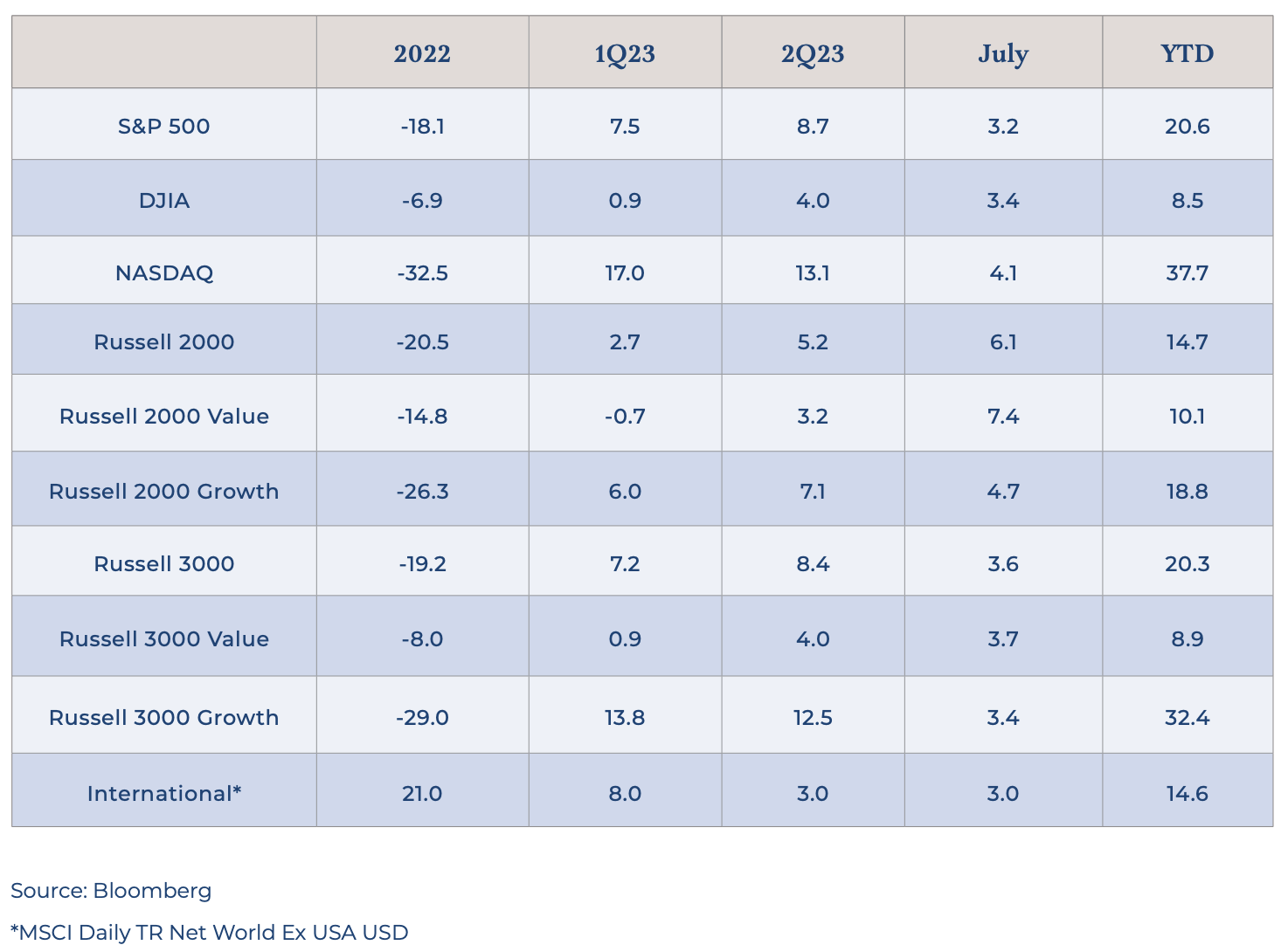

Markets continued their powerful rise during July, with all major indices advancing meaningfully. With the S&P 500 up 3.2% for the month, the year-to-date rally stood at 20.6% as of July 31. The tech-driven NASDAQ has now returned almost 38% year-to-date, and the more traditional Dow Jones is now up 8.5%.

The excitement regarding artificial intelligence, and perhaps the perceived safety of these companies versus their more leveraged, smaller brethren in an environment of higher interest rates, has created an unusually top-heavy market. While it is normal for large components of indices to produce outsized and potentially misleading movements, the advances of the “Magnificent Seven” (Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta Platforms) have historically been significant. These seven names now constitute almost 30% of the entire S&P 500.

While these stocks were up about 3.7% on average during July, there emerged some disparity in the group. Moreover, shares of smaller companies performed better last month, with the Russell 2000 advancing 6.1%. We noted last quarter that Apple had become more valuable than the entire Russell 2000 Index. Perhaps that might not be sustainable after all. Additionally, we observed that shares of what are commonly referred to as “small-cap value” stocks performed even more impressively with the Russell 2000 advancing 7.4% for the month. With the Magnificent Seven and similar “growthy” names having powered so much of the market’s advance this year, it is a healthy sign for the broader markets to begin to close the gap.

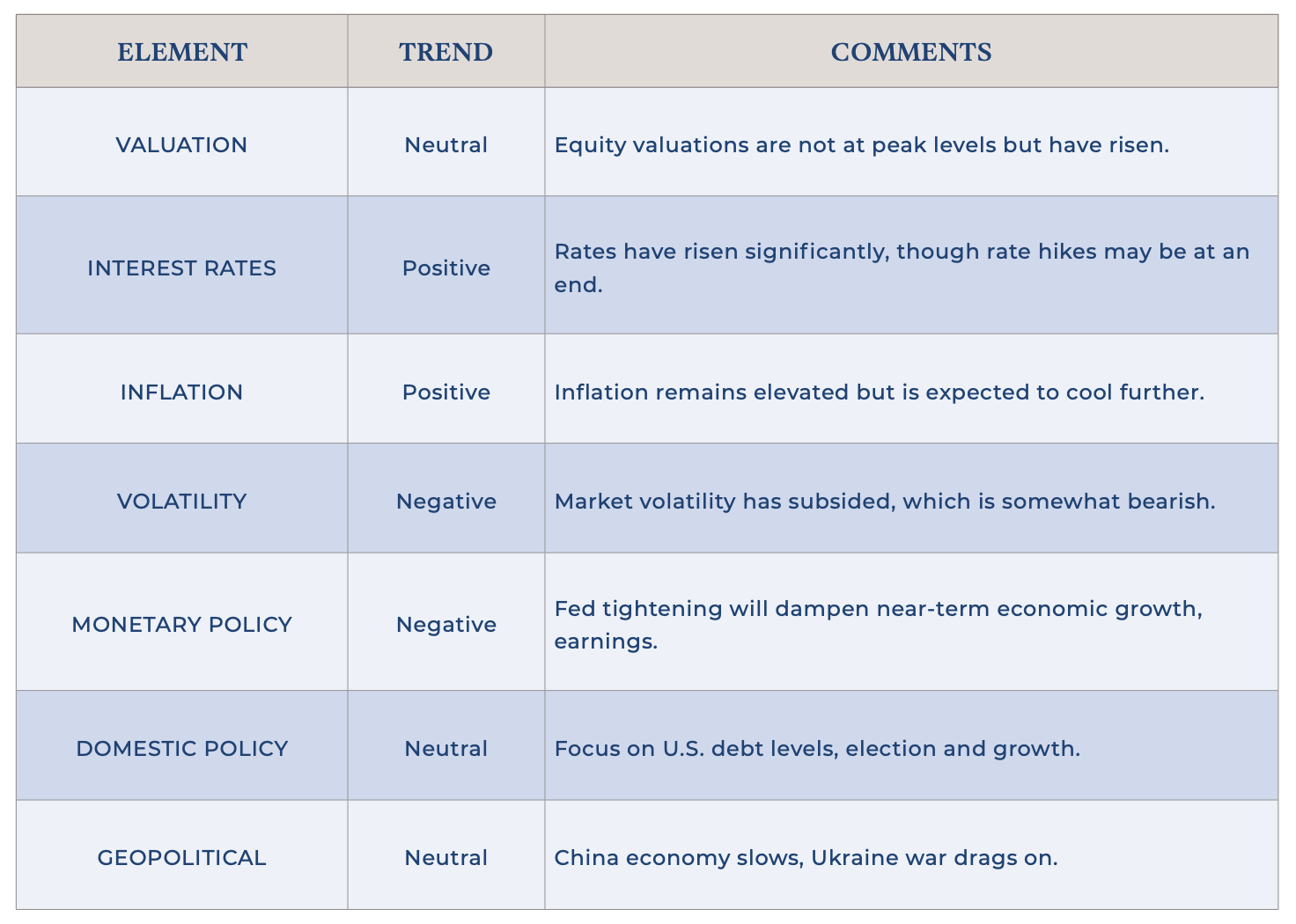

There has indeed been much to cheer about in the markets this year. Inflation is unmistakably cooling, even if going from 4% to the Fed’s long-term target of 2% will likely be at least as difficult as going from 9% to 4%. The economy has so far been able to power through the Fed’s rate hike campaign, with minimal impact on unemployment and growth. Talk of a Goldilocks scenario where we miss a recession entirely has begun. The outlook for relatively smaller companies that would benefit from a more benign interest rate environment is of particular interest, certainly given that valuations are far more compelling among those stocks. Consider this—the price-to-book ratio for the Russell 2000 is slightly more than 2x, and for the NASDAQ 100, it is almost 8x.

On the other hand, the whole point of the Fed’s actions has been to put a dent in runaway price growth fueled by supply/demand imbalances, and it remains to be seen if the Central Bank can bring about a scenario in which falling demand does not align with falling supply, which would defeat the whole point of the exercise. So far, so good though, and markets—or at least the large-cap growth neighborhood—seem to be pricing in a best-case scenario, which is always a little nerve-wracking. At least through the end of July, volatility had all but exited the financial markets, which are not particularly bullish in the near-term. The market needs volatility—a proxy for fear—to continue to appreciate. When everyone’s so bullish, there’s often trouble ahead. The Magnificent Seven are trading at The King and I prices. Let’s hope they don’t become The Dirty Dozen.

Click here to download the PDF.

For more information, please reach out to:

Burke Koonce III

Investment Strategist

bkoonce@trustcompanyofthesouth.com

Daniel L. Tolomay, CFA

Chief Investment Officer

dtolomay@trustcompanyofthesouth.com

This communication is for informational purposes only and should not be used for any other purpose, as it does not constitute a recommendation or solicitation of the purchase or sale of any security or of any investment services. Some information referenced in this memo is generated by independent, third parties that are believed but not guaranteed to be reliable. Opinions expressed herein are subject to change without notice. These materials are not intended to be tax or legal advice, and readers are encouraged to consult with their own legal, tax, and investment advisors before implementing any financial strategy.