25 May 2022

Current Conditions

“Rough winds do shake the darling buds of May” — William Shakespeare, Sonnet 18

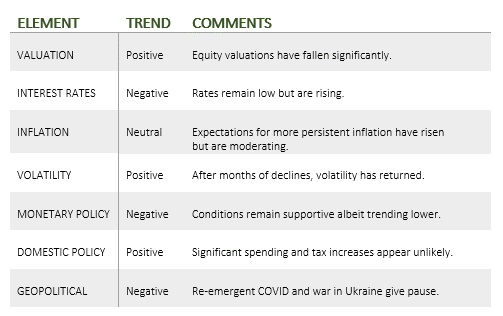

Shakespeare could have just as well been describing financial markets this month when he wrote his most famous sonnet more than four centuries ago. A more apt description does not readily present itself, let alone one less laden with financial jargon. But alas, Bards are hard to come by these days, so here we are. Elevated volatility, rising interest rates, persistent inflation, and economic uncertainty do shake the darling buds of May… Miss him yet?

The market declines that began almost immediately back in January continue as we near Memorial Day. Through yesterday, the S&P 500 Index was down about 17 percent YTD on a total return basis, while the NASDAQ was down about 28 percent. The Dow Jones Industrial Average has held up somewhat better, off about 11 percent. For the month, the S&P 500 was down about 4.5 percent, the NASDAQ about 8.5 percent and the DJIA about 3 percent. The tech-heavy NASDAQ is well into a bear market (defined by a 20 percent decline from its peak), while the S&P 500 has flirted with bear market territory on numerous occasions.

Interestingly, for all the sturm and drang surrounding markets this year, the DJIA, with its less tech-heavy constituency, has held up remarkably well. That’s because it’s the technology sector that has so far been the primary target of the market’s “slings and arrows of outrageous fortune.” Value has beaten growth in every month this year, and to date, May’s value outperformance is the largest since January. Using the Russell 2000 Value Index and the Russell 2000 Growth Index as proxies, value is now outperforming growth by more than 1600 basis points for the year. Moreover, value is now well ahead of the growth for the trailing one-year period and is now poised to overtake growth on a five-year basis also. It’s a stunning reversal in both scale and speed for financial markets, which have been led higher by technology and growth-oriented issues for years, only to have 100 percent of that outperformance “vanish into air.”

Since the COVID-19 panic and recovery of March 2020, market valuations, particularly in the US, had been elevated, buoyed by oceans of fiscal support, ultra-low interest rates, and of course, an economy that proved far more robust than many thought possible amid the global pandemic. Fully all of that premium valuation has been extinguished during the last five months. As of now, the forward price/earnings ratio of the S&P 500, at 16.7x, has fallen below its 25-year average of 16.9x. Of course, this measure could continue to fall, and as earnings estimates come down due to persistent inflation, the index could continue to drop even if this ratio stabilizes, but this is no longer an expensive market, at least by this one closely-watched yardstick.

The terrible war in Ukraine and COVID-19’s continued burden on the global economy through supply chain disruptions and labor scarcity have dominated headlines, but the true ghost on the platform in Elsinore Castle this year has been rising interest rates. Of course, rates are rising in response to inflationary forces unleashed and exacerbated by Ukraine, COVID-19 and the world’s responses to them, but the receding liquidity that accompanies rising rates is what we are seeing play out in changes in market prices. Ten-year Treasury yields more than doubled between year-end and May 6th, creating a huge repricing in fixed income markets in addition to the equity markets. To the dismay of 60/40 portfolio holders everywhere, bonds did not provide the desired protection from equity market volatility.

“Oh fortune, fortune! All men call thee fickle!” Romeo and Juliet

Then again, if this market has taught us anything this year, it is that circumstances change quickly. On December 31, the market was pricing in just three 25-basis-point rate increases for the year. Fast forward to April 30 and the market was expecting 10 such rate hikes, plus another in February 2023. It is worth noting then that markets have in recent weeks taken on a slightly but distinctly more dovish view, with the current curve pricing in just seven hikes in 2022. Bond markets have stabilized. Five-year inflation expectations, which had jumped to 3.5 percent back in March, are back down to 2.9 percent—not far from where we were at the start of the year. Consumer sentiment is shockingly low, housing starts and building permits have crept lower, and jobless claims have recently been slightly higher than expected. If the economy is cooling a bit, inflation will eventually follow, and interest rates are starting to react.

None of this means we are advocating buying growth stocks with both hands; we never have and almost certainly never will. Markets are fickle, after all. But what we think all of this means is that the areas of the market where the historical evidence suggests that premium returns exist—value, small cap, and international, is where the future premiums do in fact exist.

For the vast majority of investors, bear markets are no fun. Growth is in a bear market at this moment, and it is during bear markets when people rediscover the meaning of margin of safety—the ability to point to an estimated stream of future cash flows generated by a company and say something other than “we are such stuff as dreams are made on.” In a bull market, it’s easy to find someone whose dreams are even more optimistic than your own who will pay you a premium for what you own. In a bear market, stocks return to their rightful owners. And it wasn’t Shakespeare who said that—it was J.P. Morgan.