Americans have faced high inflation and rising interest rates over the last few years. Necessities such as food, housing, and healthcare are significantly more expensive than pre-pandemic, creating challenges for donors and the charities they support. Here are some tax-efficient gifting strategies donors can use to maximize their impact on important causes as we approach the end of the year.

1. Consider bunching gifts if you cannot itemize because of higher standard deductions.

The 2017 Tax Cuts & Jobs Act nearly doubled the standard deduction for U.S. taxpayers through 2025. The 2023 standard deduction for individual taxpayers is $13,850 and $27,700 for joint filers. This change in the law has decreased the number of taxpayers who itemize deductions on their tax returns. If you are a taxpayer who utilizes the standard deduction, consider a bunching strategy where you consolidate gifts into one tax year instead of spreading them over multiple years. This strategy allows you to itemize your gifts within the year you fund them and benefit from the charitable deduction. A bunching strategy utilizing a Donor Advised Fund (DAF) is illustrated later in this article.

2. Donate appreciated securities instead of cash.

Many investors hold appreciated securities that will generate a capital gains tax if sold. Donating securities held for over a year to a charity allows both the donor and the charity to bypass the capital gains tax, while the donor retains the equivalent tax deduction they would have received had they donated cash, up to 30% of their Adjusted Gross Income (AGI). Wash-sale rules do not apply to securities donated to charity, so a donor who wants to restore their position can immediately purchase new shares of the same security at a higher cost basis. This approach lets you maintain your asset allocation while minimizing the tax due on a future sale.

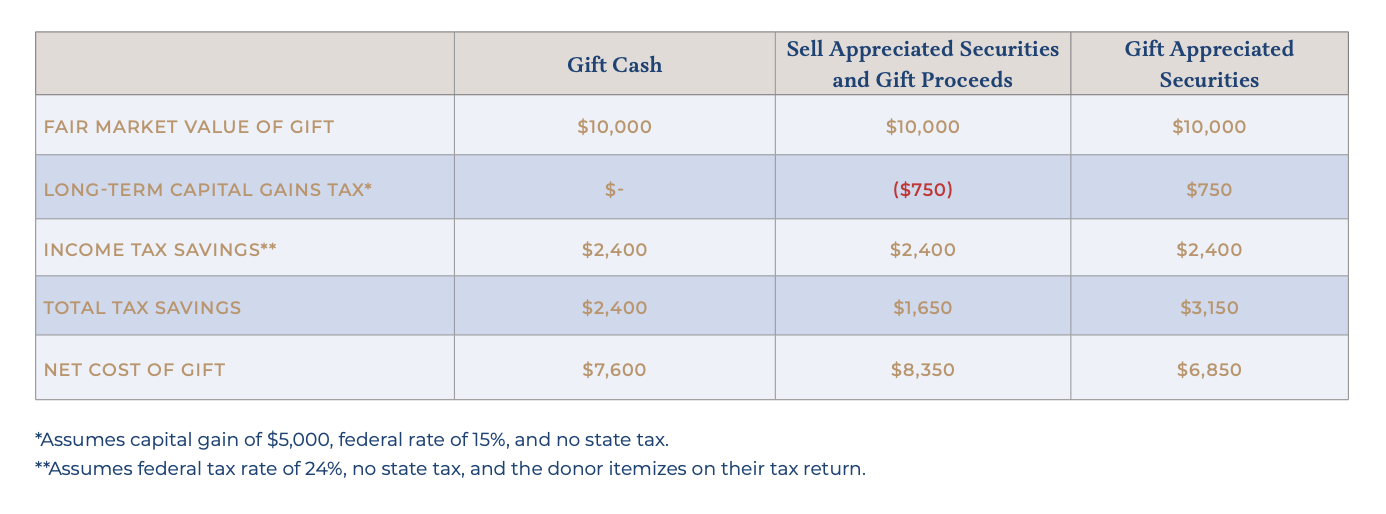

Below is an example showing the cost of making a $10,000 charitable gift using different methods. As you can see, gifting appreciated securities is a more tax-efficient strategy than gifting cash.

3. Make a Qualified Charitable Distribution (QCD) from an IRA.

An IRA owner aged 70 ½ or older is permitted to direct up to $100,000 annually from their IRA to one or more charities, known as a Qualified Charitable Distribution (QCD). QCDs must be made directly from the IRA to the receiving charity (or charities) and can satisfy all or part of an individual’s Required Minimum Distribution (RMD), which begins at age 73. QCDs are excluded from an individual’s Adjusted Gross Income (AGI), which is important since AGI impacts Medicare premiums, taxes on Social Security benefits and eligibility for certain tax credits and deductions such as unreimbursed medical expenses. QCDs may be especially beneficial for those who do not itemize and instead take the standard deduction since it enables them to realize a tax benefit for their charitable gift.

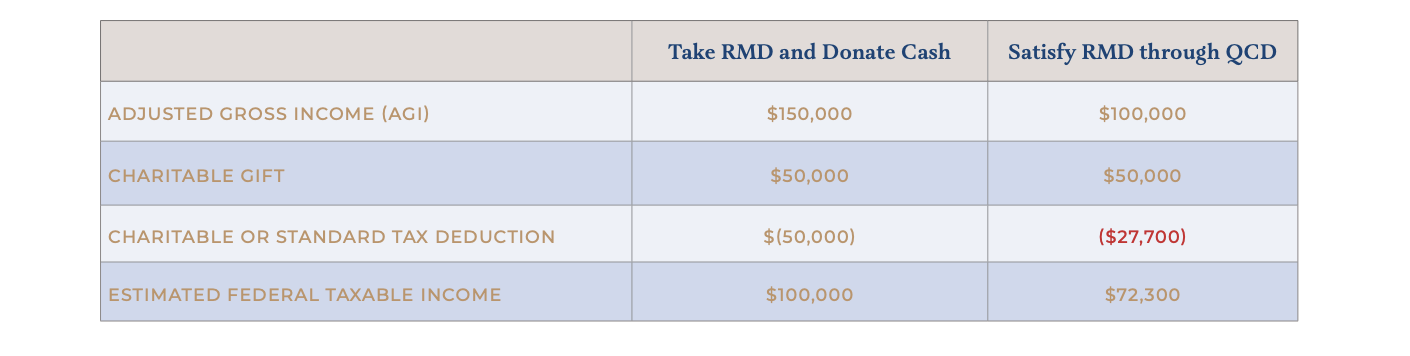

For example, let’s assume an IRA owner has an RMD of $50,000 and other ordinary income of $100,000. They file taxes jointly and are only subject to federal income tax. If they take the full RMD, their AGI increases to $150,000. After taking their RMD, they make a cash gift of $50,000 to charity. This results in an itemized charitable deduction of $50,000 (assuming no other deductions) and a total taxable income of $100,000.

An alternative option would be to direct their $50,000 RMD straight from their IRA to the charity. This method will result in an AGI of $100,000 and taxable income of only $72,300, assuming they take the standard deduction of $27,700. Both scenarios are illustrated below.

4. Consider contributing to a Donor Advised Fund (DAF).

A Donor Advised Fund (DAF) is a charitable giving account established at a 501(c)(3) sponsoring organization such as a community foundation. Donors can make an irrevocable charitable contribution of cash, securities, or private business interests, possibly receive an immediate tax deduction, and then direct grants to other charities over time. Assets in the DAF can be invested, and all appreciation and income are tax-free. DAFs may be more suitable for donors using a bunching strategy or for those who want to pre-fund their charitable giving during a high-income year to take advantage of the larger tax deduction.

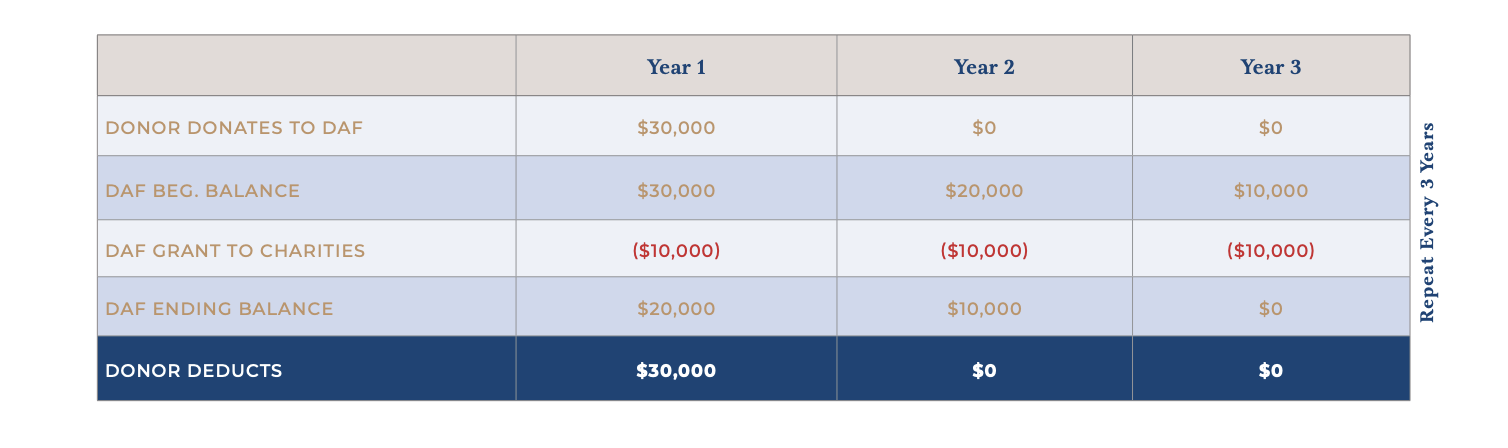

Below is an example of a bunching strategy using a DAF. A donor desires to donate $10,000 per year to charity. They could fund these gifts annually from a personal account, but they would not be able to itemize and realize a charitable deduction since the standard deduction for an individual taxpayer in 2023 is $13,850 and exceeds the amount of the charitable gift (assuming the donor does not have additional deductions). Instead, the donor chooses to contribute $30,000 to a DAF, receives the full charitable deduction for the gift, and uses the funds to make charitable grants of $10,000 per year to charities of their choosing.

Charitable goals are an important part of a comprehensive financial plan. Working with an advisor to develop a thoughtful, tax-efficient strategy enhances the likelihood of accomplishing your goals and strengthens the impact your support has on the causes important to you.

Click here to download the PDF.

For more information, please reach out to:

Walker Douglas, CFP®, J.D.

Associate Wealth Advisor

wdouglas@trustcompanyofthesouth.com