Changes: Do Higher Rates Make It Different This Time, Or the Same Just with Higher Rates?

Financial markets are vast and deep and largely unpredictable in the short term. In a world where extreme positions of all kinds garner attention and sometimes get rewarded, it is important — even if it’s not easy — to remember this. Our investing philosophy rests on the assumption that, while markets may not always be “correct,” they are efficient at incorporating publicly available information and therefore prices must move toward equilibrium over the long term. That’s what makes markets so interesting. Like history or anthropology, there’s precious little that’s actually “new under the sun” when it comes to markets.

But, also similar to history, markets are never exactly the same from minute to minute or decade to decade. It’s that dynamism, after all, that creates the opportunity to grow wealth over time. As investors, we must be humble enough to know that attempts to predict the future are generally foolhardy but shrewd enough to recognize opportunity when it exists. That’s why times such as these are so interesting — when patience and a careful appreciation of something as “boring” as interest rates, as opposed to aggression and chasing multiple expansion, seem poised to pay their own dividends. Not because it’s different this time, but because it’s the same, only with higher interest rates.

Strange Fascination

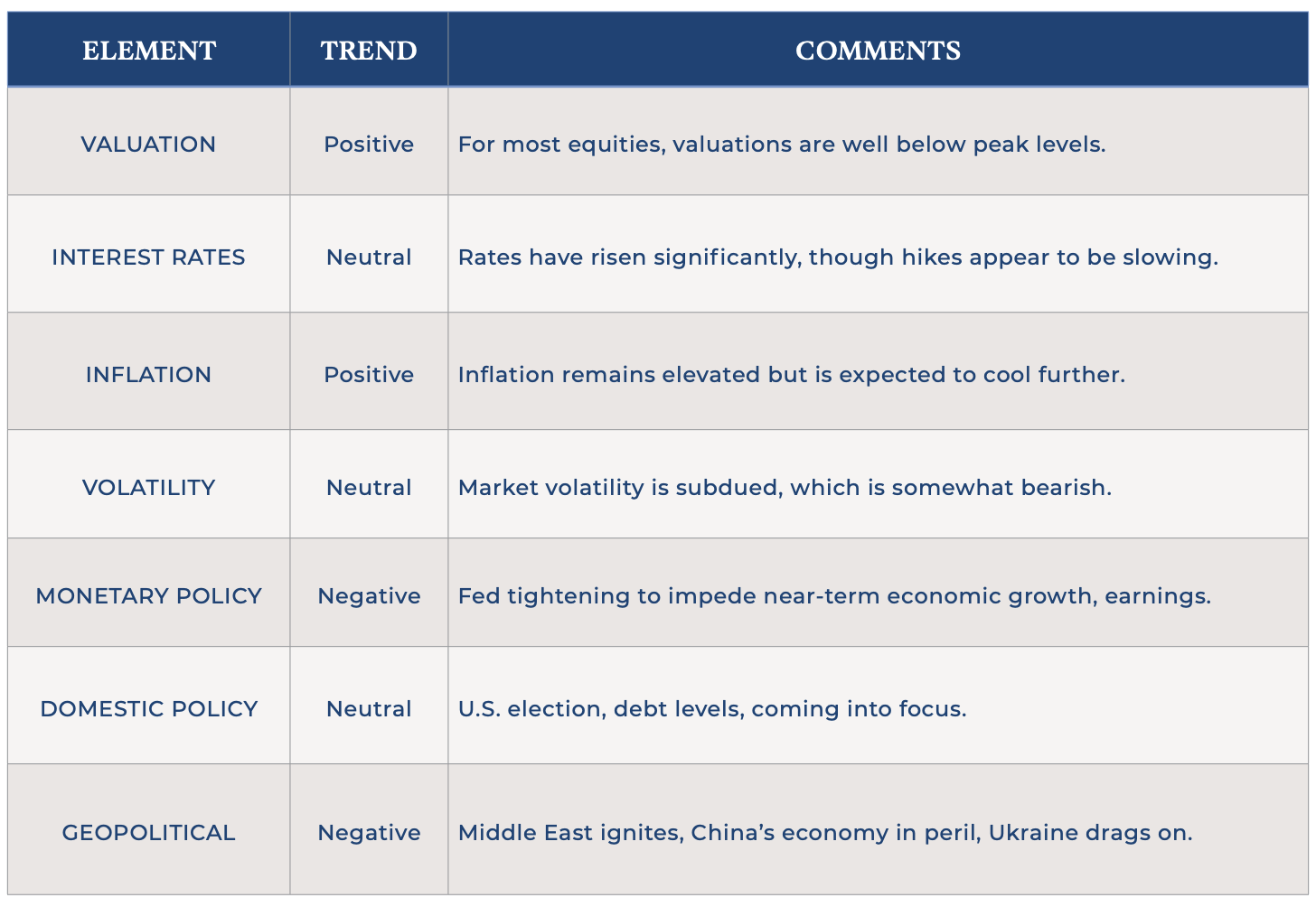

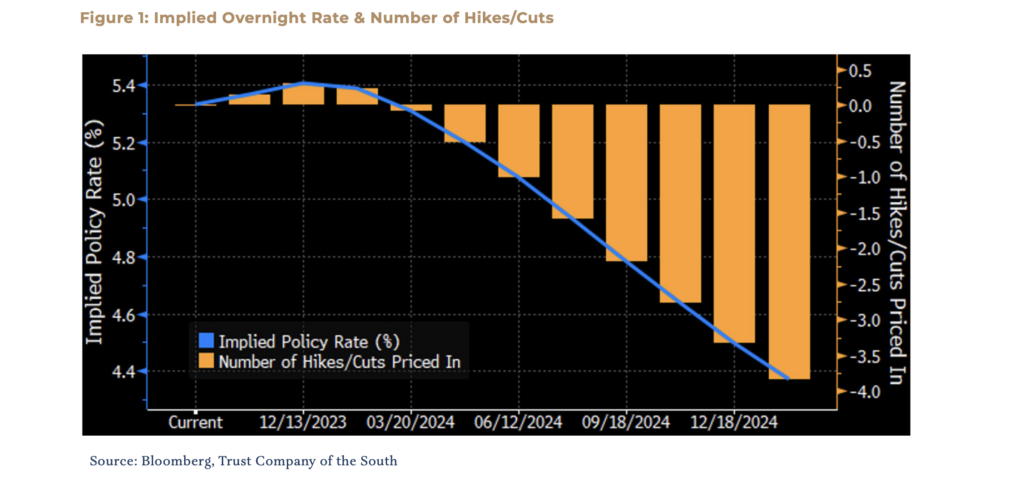

The question vexing many investors right now is this: what do ‘higher for longer’ interest rates mean for the economy and financial markets? Until this past quarter, it’s fair to say that many market participants believed short-term interest rates, which were effectively at zero 20 months ago, would be poised to decline in the near future. Only a few months ago, the Fed Funds futures curve showed that the market was pricing in a rate cut in September — last month. Today, the market expects the Fed will wait until next summer to cut. Turns out, higher interest rates are not super transitory, and that of course, is because higher inflation turned out not to be super transitory.

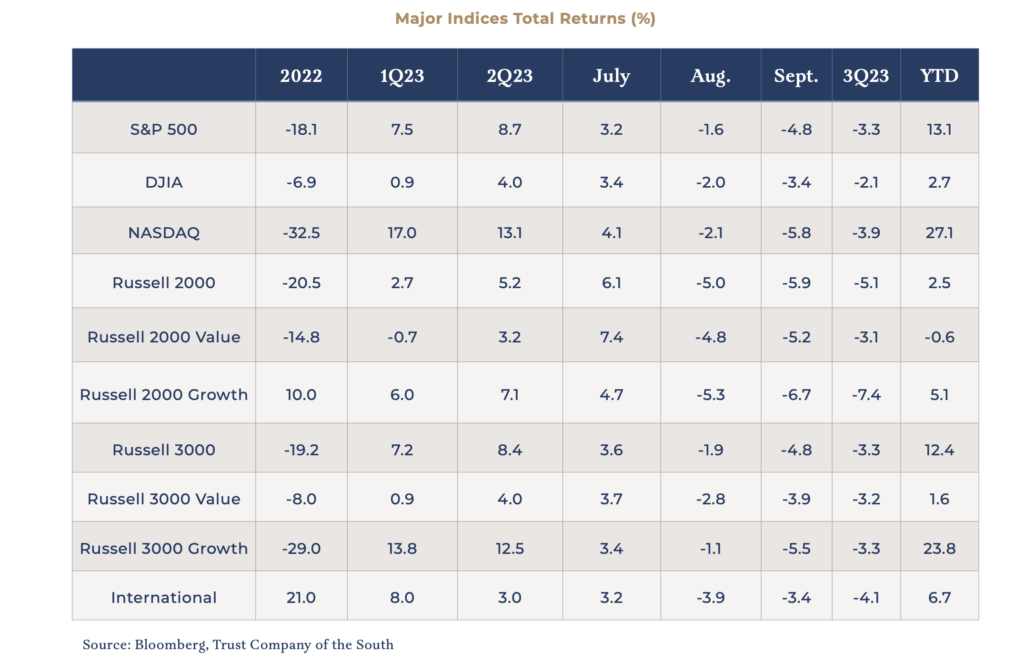

After all, it was just back in July when the market reached its peak for the year. Inflation had decreased enough to spark hopes of a ‘hawkish pause’ and create a highly favorable backdrop for both stocks and bonds, with the expectation that rates would fall. The only major concern at the time was that this year’s impressive rally, particularly in stocks, was quite narrow.

In August, major market indices turned slightly negative, which could be easily explained away as normal seasonality, especially after such a strong bull throughout the year. However, September presented a different story. Major indices showed a significant downturn, with the S&P 500 down 4.8%, the Dow Jones off 3.4% and the NASDAQ lower by 5.8%, as the market-leading technology shares began to roll over.

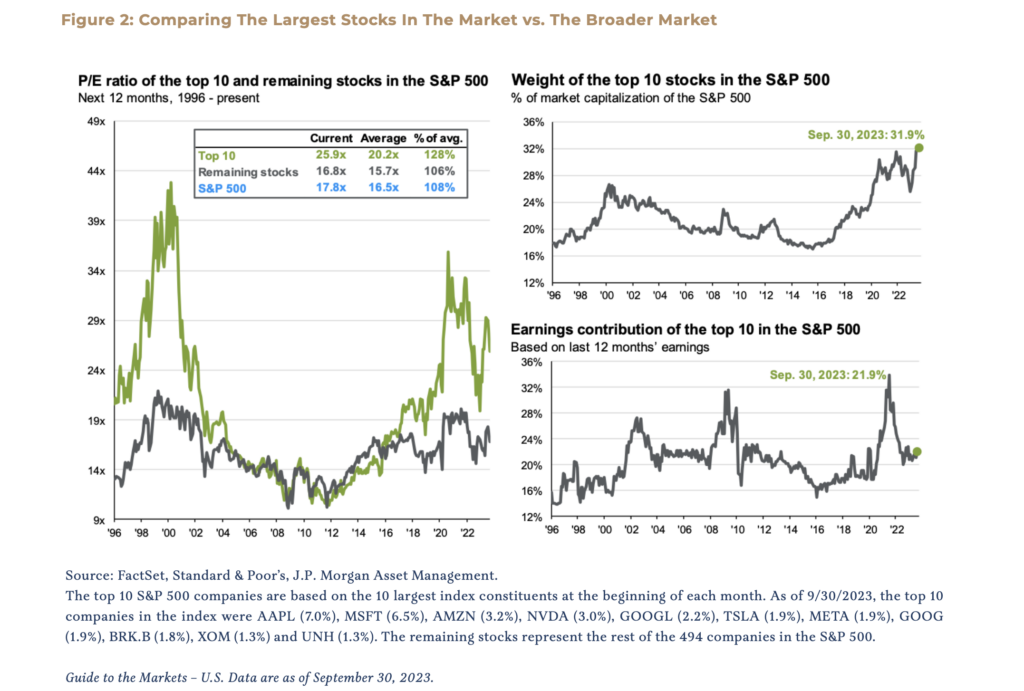

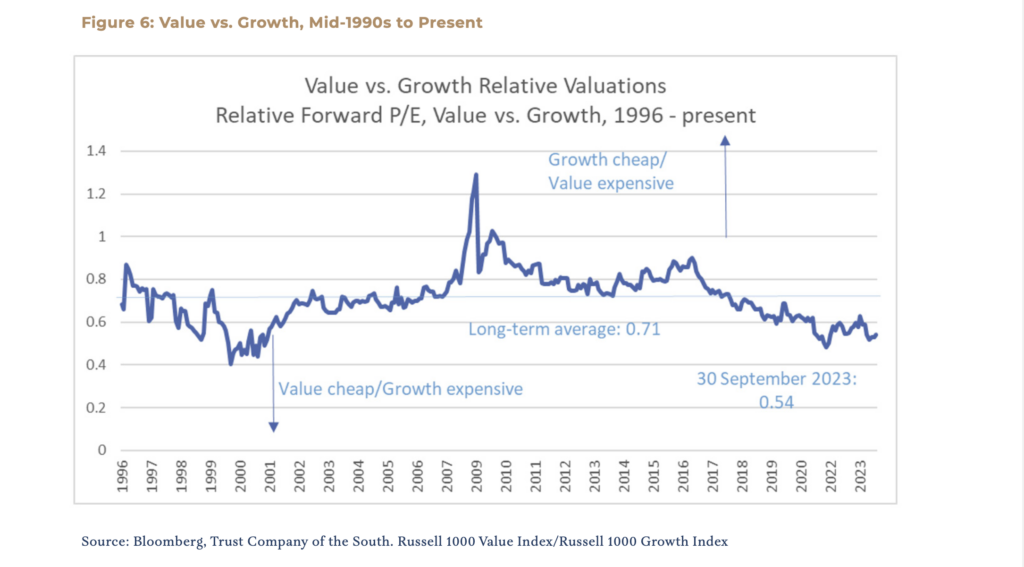

The healthy broadening for which we had been hoping was occurring, but not in the way we had hoped, with more stocks gaining ground on the leaders. Instead, it was happening on the way down, with prices of the more expensive shares dropping faster than less expensive shares. Unfortunately, for growth investors, that’s usually how it unfolds. However, it’s not as if growth has relinquished its outperformance over value this year. That gap remains substantial, and mega-cap growth has rebounded so far in October. This market is still extremely top-heavy, with the top ten stocks in the S&P 500 representing almost 32% of the index’s overall market capitalization. That’s a significant percentage — the largest since at least the mid-1990s.

We do not engage in the game of attempting to guess whether the sky-high, price-to-earnings multiples paid for some of the largest and most innovative companies in the world are justified. They may be, and they may not be. History suggests that the stock prices of many of these market darlings may have less rosy futures than the companies themselves.

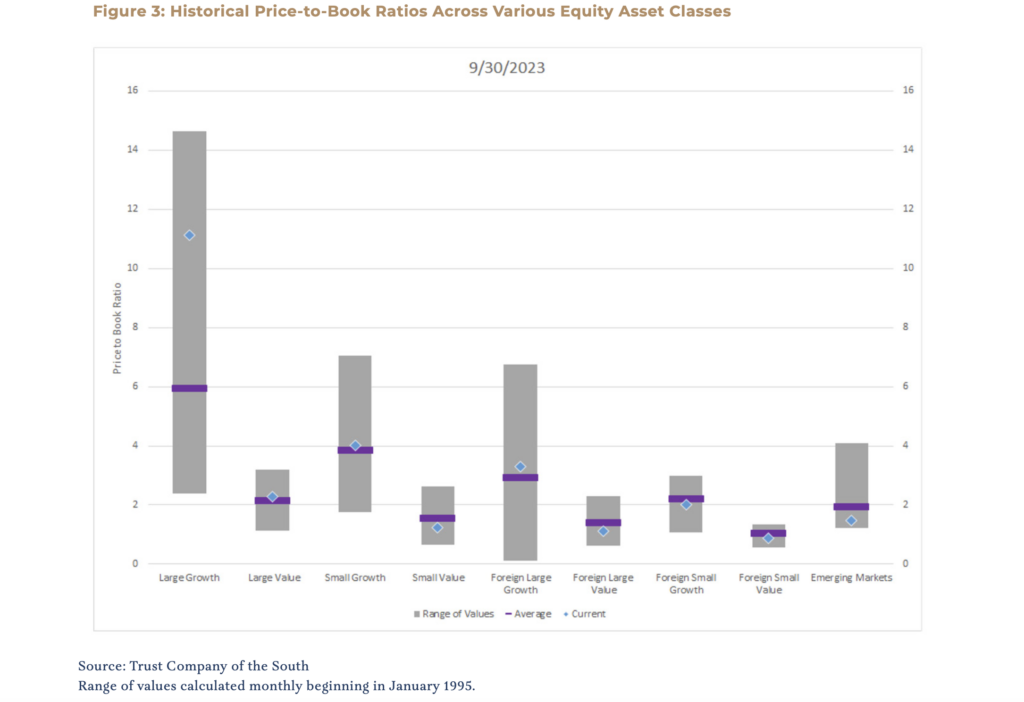

While these Magnificent Seven companies (Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta Platforms) are represented in client portfolios, we maintain our relative tilts away from nosebleed valuations. The recent bout of market volatility has indeed pushed valuations across many asset classes lower, quite close to their long-term averages. However, the glaring exception is large-cap growth, where price-to-book value is still well north of 10x. Fast-growth companies are expected to be more expensive than slow-growth companies, but not by this much.

So, how do changing interest rates impact financial markets? Well, the short answer is — a lot.

Interest rates affect asset prices the same way gravity affects the physical world. When gravity is low, it doesn’t require much energy to move a relatively great distance. When gravity is high, it takes a lot more. The same principle applies to interest rates. When they’re low, capital is more abundant, and prices tend to rise more easily. Businesses and individuals alike have easier access to capital. As interest rates rise, and savers get paid real money to keep their money in interest-bearing accounts and NOT grant capital to anybody with a business plan, asset prices have a way of not appreciating rapidly.

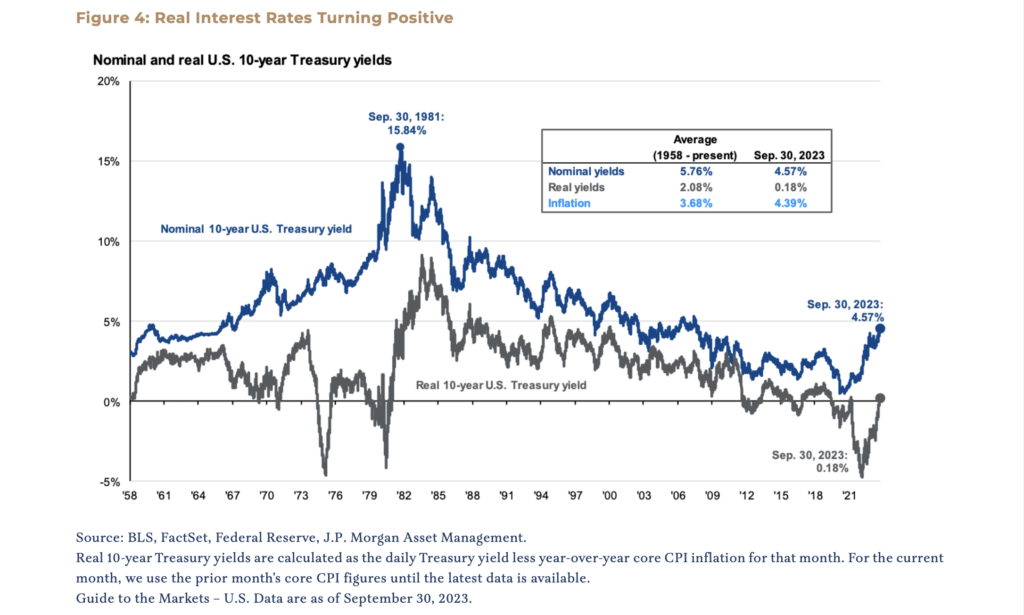

While interest rates have been climbing steadily for many months now, it is only within the last several weeks that we have begun to experience positive real interest rates in the U.S. That is to say that, even with last year’s rate hikes, real rates (nominal rates minus inflation) remained negative. Now, for the first time since the pandemic and for one of the few times in more than a decade, it costs real money to borrow money.

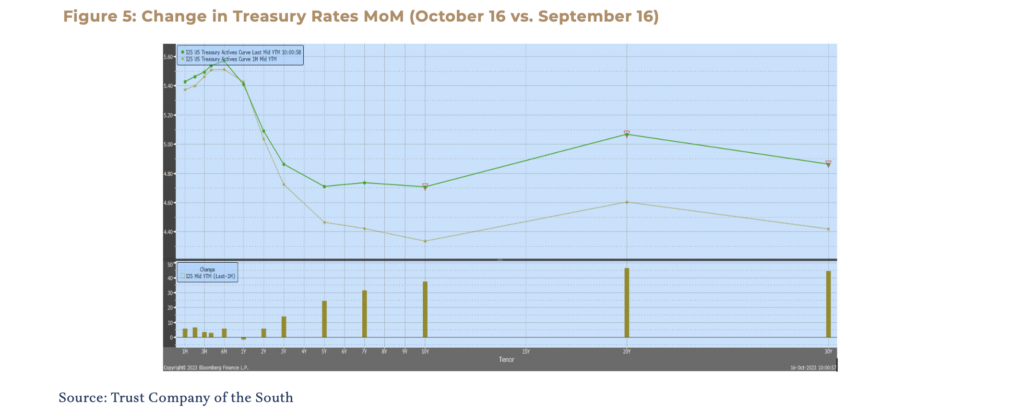

Of course, most folks are aware that short-term interest rates have gone from zero to well above 5% since the beginning of 2022. That’s part of what affected markets last year. However, what’s been happening more recently, though, may have an equally significant impact going forward — long-term rates have started to climb higher. This occurs as the market begins to factor in higher baseline inflation and other risks, such as credit, over a more extended period.

This is not a doomsday scenario by any stretch of the imagination. However, it does suggest we are entering a more challenging environment for corporate profitability and borrowing. Furthermore, as liquidity tightens, the environment for asset appreciation becomes more demanding. When momentum fades, justifying asset valuations can become increasingly difficult. In this kind of environment, profitability and cash flow become especially important. While this is not a doomsday scenario, it is worth noting that in certain corners of the market in recent years, businesses with cash flow, which were not reinvesting all available capital into themselves, drew very little interest from investors.

While we are not predicting the future, we permit ourselves to observe that this new interest rate environment is starkly different from the prevailing one that has dominated markets for years, favoring growth investing heavily. What does this mean for stocks going forward? Well, one argument in favor of large growth companies is that they do not heavily rely on debt. In fact, many of them have substantial reserves of cash to put to work. That’s certainly true, but investors in tightening markets might not be willing to pay such high multiples for these great businesses. Neither might they be willing to pay as much to own other businesses, particularly those with higher debt burdens or low to negative profits.

On the other hand, this environment could be a boon to bargain hunters, who have been muscled out by investors with looser purse strings for many years, and also for lenders. While bonds have been a great way to take risks and earn next to nothing for years, this could be changing. Bond yields are much higher than they were less than two years ago, and savers earn far more now than before. Meanwhile, the yield on stocks has not climbed anywhere near as much as bond yields have. Bonds have repriced, and stocks largely have not.

We Can Be Heroes?

Perhaps equity markets, with their formidable discounting abilities, have already factored in expectations of the Fed cutting rates again next summer. This would seem to be a highly constructive setup that would benefit asset prices across the board, especially stocks in smaller companies that stand to gain the most from easing financial conditions. Wayne Gretzky always said he wanted to stay where the puck was going to be, not where it is now, so maybe we should be attempting to look a year ahead. The trouble is, of course, that the data suggests that it’s easier for Wayne Gretsky to find open ice than it is to predict the future of financial markets. However, it is fair to say that the significant movements we have seen in interest rates, and their current levels are likely to have real consequences on the global economy, which will increasingly be reflected in asset prices, as information becomes available. Moreover, the potential impact of these higher rates on asset prices seems to support evidence that, over the long run, investors should, on balance, avoid overpaying for stocks, even if it means forgoing some asset price appreciation for extended periods.

To put it bluntly, value stocks seem particularly well-positioned in the current environment compared to growth stocks. Value is not quite as undervalued as it was in comparison to growth during the tech bubble that burst in 2000, but it is not far from those levels. Again, we are not attempting to predict the future, but rather position portfolios for the most favorable outcomes based on probability. We’re just saying… we rather like our chances right now.

“I watch the ripples change their size,

but never leave the stream of warm impermanence.”

The paradox of investing by following long-term empirical evidence is that it essentially required almost daily bombardments of information that could be interpreted as contradictory, suggesting that the world has changed, a new paradigm has emerged or a new technology has rendered the old rules obsolete. The very reason it works is because it seems like it does not for sometimes long stretches of time. That’s the great irony of being a value investor. One’s greatest opportunities are, by definition, preceded by the greatest challenges — periods during which it seems there’s a better mousetrap elsewhere. It’s only when one zooms out for the wide shot, over the long term, that the full perspective is gained. That’s when it’s most clearly seen that what seems like changes are, in the fullness of time, just features of the landscape. The victory of the tortoise is only made possible by the nature of the hare.

“Turn and face the strange changes,

Oh, look out you rock and rollers,

Turn and face the strange changes, Pretty soon now you’re gonna get older…”— David Bowie, Changes

Click here to download the PDF.

For more information, please reach out to:

Burke Koonce III

Investment Strategist

bkoonce@trustcompanyofthesouth.com

Daniel L. Tolomay, CFA

Chief Investment Officer

dtolomay@trustcompanyofthesouth.com

This communication is for informational purposes only and should not be used for any other purpose, as it does not constitute a recommendation or solicitation of the purchase or sale of any security or of any investment services. Some information referenced in this memo is generated by independent, third parties that are believed but not guaranteed to be reliable. Opinions expressed herein are subject to change without notice. These materials are not intended to be tax or legal advice, and readers are encouraged to consult with their own legal, tax, and investment advisors before implementing any financial strategy.