The Grateful Fed

The second quarter was a news editor’s dream. There were scads of fascinating stories competing for headlines—among them, the geopolitical drama in Russia, the Titan submersible tragedy and of course, the soaring financial markets, each capturing everyone’s attention in different ways. In fact, there was so much news action that one could be forgiven for overlooking an important development that occurred in early June, which was when the world learned that Jay Powell, chairman of the Federal Reserve of the United States, is a Deadhead. After Powell was spotted at a Dead & Co. show near Washington, D.C., a discussion of his outing, and his decades-long association with the Dead, even made its way into his appearance before the House Financial Services Committee. Of course, the real significance of this revelation is that the Grateful Dead’s journey from Haight-Ashbury to the Federal Reserve, from counterculture to the discount window, is complete, which can only mean it is now officially appropriate to incorporate Grateful Dead references into an investment newsletter.

Truckin’

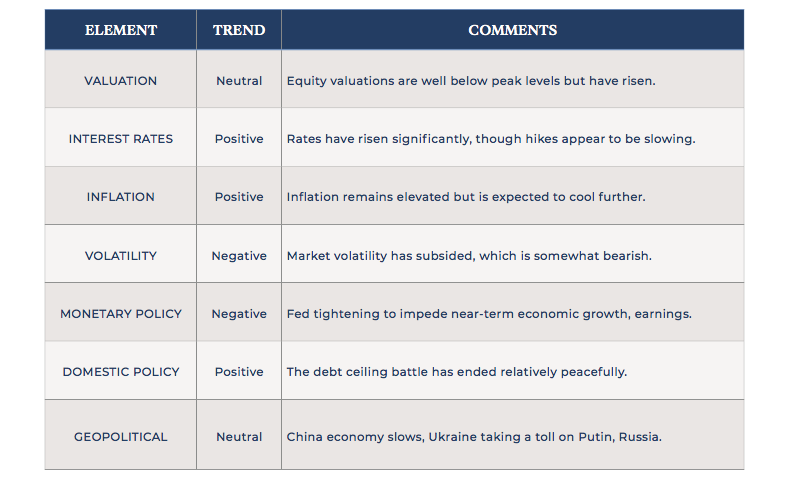

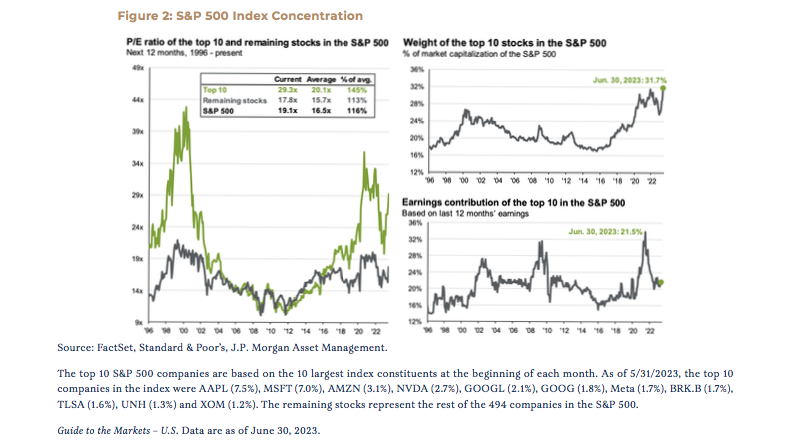

Financial markets soared in the second quarter. The S&P 500 returned 8.7%, bringing the year-to-date return to 16.9% for the year. June was the best month for the index since October 2022, capping the third straight quarter of gains. Optimism regarding tech shares, particularly among companies seen to benefit from artificial intelligence, pushed equity markets significantly higher. The tech-laden NASDAQ returned 13.1% for the second quarter and is now up 32.3% for the year – its best first half since 1983.

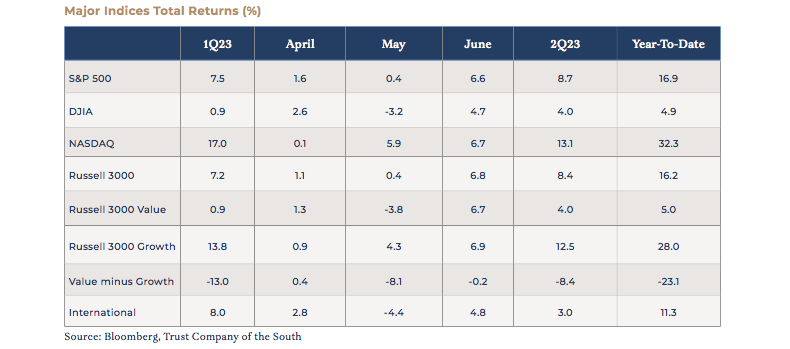

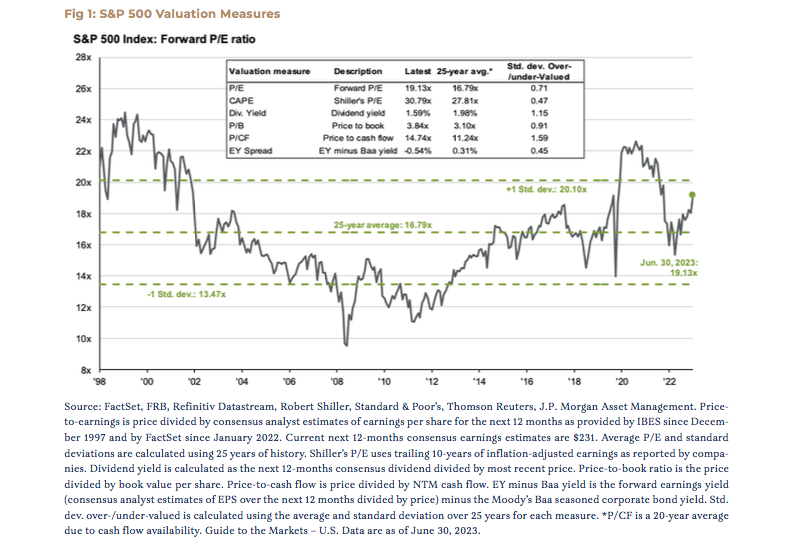

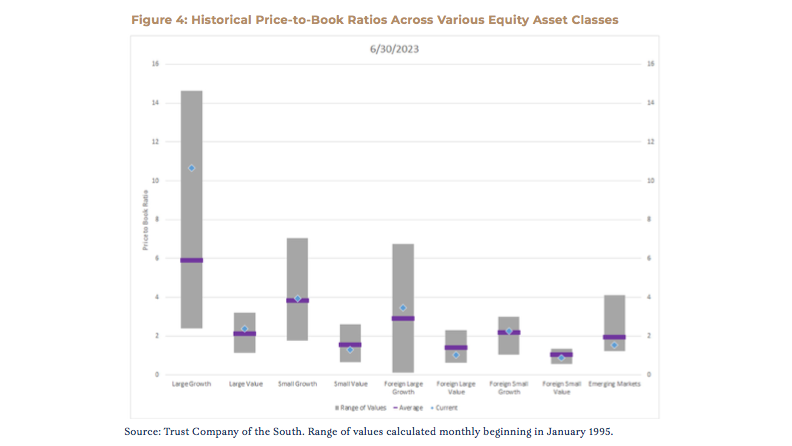

Valuations have become more stretched, particularly among the market’s high-fliers. At 19.1 times earnings, the overall market has become relatively expensive. Nevertheless, due to the concentrated nature of the gains in only a handful of stocks, the prices of most stocks have experienced significantly less movement. In other words, much of the market still looks relatively attractive. An equal-weighted basket of S&P 500 stocks, while up just 7% for the year, outpaced the market-weighted index during June. This broadening is generally considered a healthy sign for the overall market.

Even with the broadening, performance has still been quite the tale of two markets. With the gains highly concentrated among large-cap growth, small-caps and value stocks have lagged measurably. While it’s normal for the largest stocks to constitute an outsized component of the S&P 500, the index has never been this top-heavy in modern history. As of June 30, the weight of the top ten stocks in the index was almost 32% of the total market capitalization. That’s a lot. For good measure, the top ten stocks are almost 50% more expensive than their long-term average. That’s also a lot, especially in an environment where interest rates have risen so dramatically.

Meanwhile, the poor old brokedown Russell 2000, perhaps the most widely followed small-cap index, is up only 8% for the year. The Russell 2000 Value Index is up just 2.5%. So, what is driving this disparity? Casey Jones?

Not Fade Away

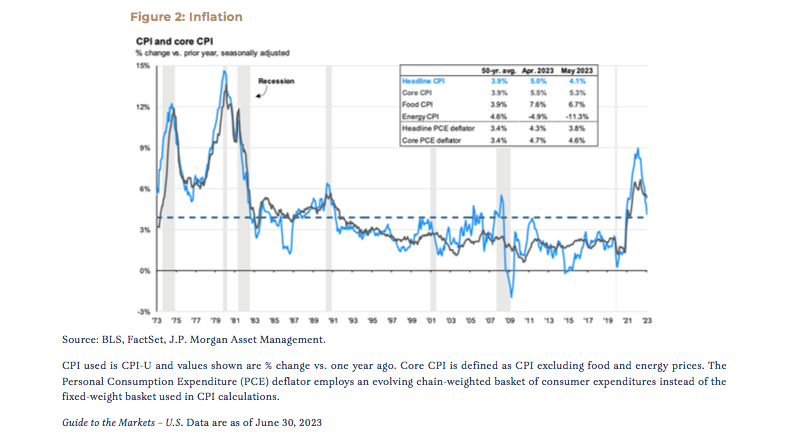

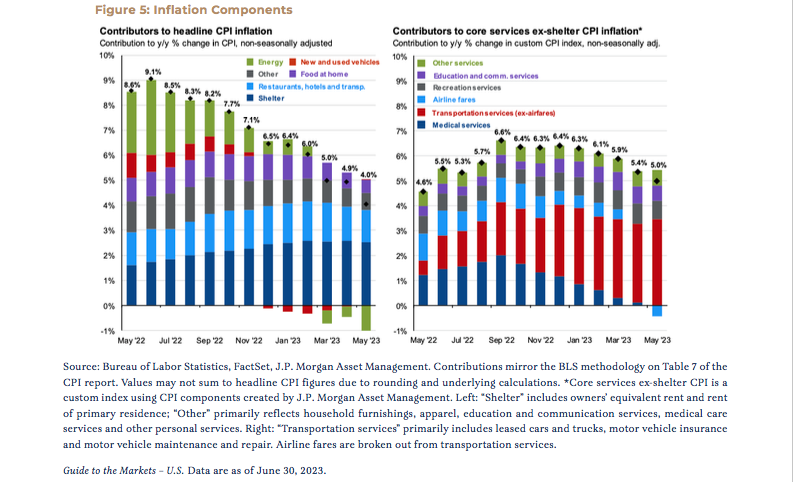

One explanation is simply the persistence of inflation, which has lasted far longer than our friends at the Grateful Fed expected. It’s just not fading away…yet. While inflation has cooled, its persistency in areas, such as wage growth, which can feed into a vicious circle of price acceleration, has the Fed’s attention. In theory, inflation is more difficult for smaller firms to manage. Suppliers more easily pass along input costs, and customers are less likely to accept price increases. Meanwhile, at the top of the food chain, super-large firms are better protected. Inflation has certainly cooled compared to this time last year (4.1% in May 2022 versus 8.6% in May 2023), but that’s still far above Jerry Powell’s long-term target of 2%. While the market welcomed the news that the Fed would officially pause its rate hike campaign in June, short-term interest rate futures have continued to move higher, and the Central Bank appears to have the green light for at least one more hike this year.

Another reason the market is so bifurcated might be that it has sorted companies that have lots of leverage into the cheap heap and companies that do not have lots of leverage into the heap for which it is willing to pay more. Smaller companies in more traditional industries tend to have more debt than the larger companies, and most certainly the largest tech companies. The debt-to-enterprise value ratio of the tech-heavy NASDAQ is just 17%. For the S&P 500, it’s 30%. For the Russell 2000, the number is 49%. The further down the food chain, the larger the impact of higher interest rates. Coincidence?

Another way of looking at this is to examine the ability of companies to cover their interest payments by comparing EBIT (earnings before interest and taxes) to interest. Using 12-month trailing interest, companies in the S&P 500, a large-cap index, appear far more capable of handling their interest burden than their smaller counterparts in the Russell 2000 (9.2x versus 2.6x).

On the other hand, if the market is already looking past the current level of higher interest rates, then the biggest future beneficiaries would be these smaller firms, as rates normalize. If there’s one thing for which the Fed can indeed be grateful, it’s the prospect of falling inflation due to expected easing in housing costs. Housing represents about 40% of the total core consumer price index, which is by far the largest input, and due to the way it’s calculated (a rolling average), it will start rolling over later this year.

Beyond the cooling housing inputs and pockets of real estate, especially office, the economy has proven far, far stronger than expected, which has certainly contributed to the strength of financial markets this year. Fears that energy costs would skyrocket because of the war in Ukraine did not materialize, as Europe was able to secure alternate sources of fuel amid a milder than expected winter. The labor market is still quite tight, with the unemployment rate at an impressive 3.6%. In short, the economy just has not been shaken by higher interest rates. Yet.

Looks Like Rain

With inflation still at 4.1%, real interest rates are still effectively zero. They’re no longer negative like they were two years ago, but zero interest rates are not particularly restrictive. The Fed Funds futures curve is now pricing in one more rate hike this year with plans for the Fed to begin easing in June 2024. Only three months ago, the market expected the Fed to begin cutting in September, and from a lower rate. The market is now factoring in rates 50 to 75 basis points higher than it was in April. The bottom line is that the Fed just hasn’t done much to slow the economy yet, and it seems reasonable to expect that the Fed might not be finished after all. In other words, we have not yet felt any economic pain, and the pain is supposed to be the point. Rates seem poised to remain higher for longer.

If that turns out to be the case, it is increasingly difficult to justify valuations at the top of the market. Using a favored metric, stocks are nowhere near as attractive as they were even at the most recent peak in January 2022. Subsequently, when considering the earnings yield (which is the reciprocal of the price to earnings ratio and provides a simpler means to compare stocks with bonds), the S&P 500 was traded at 4.7%, whereas the 10-year Treasury yield stood at 1.6%. Since then, the risk-free rate has more than doubled to 3.8%, and earnings yields have only climbed to 5.2%. Viewed that way, stocks do not seem particularly inexpensive compared to zero-risk.

The Race Is On

For some time now, the near-term, bull case has been that rates will decline as inflation recede, which should support a favorable environment for equities. The near-term, bear case has been that higher interest rates will have real-world economic implications, slowing economic growth and triggering financial problems. The reality is that both can be true at the same time, and this scenario is the proverbial Goldilocks outcome, neither too hot nor too cold. So, how does one embrace this notion, while looking at a yield curve that’s as inverted as it has been in decades, which so often signals a major economic slowdown? Perhaps the curve reflects the belief that inflation will die off without taking the economy with it. In any case, one can make the argument that it’s an especially good time to be positioned to take advantage of outperformance in the market beyond the handful of large companies that have thus far led the rally this year.

Deal

As is so often the case, we find curious wisdom in our reading beyond financial outlets. The Fourth of July is always a fun time to listen to the Grateful Dead. Their music, as quirky as it can be, is uniquely American. To paraphrase Walt Whitman, it contains multitudes. It may be a bit of a stretch, but when contemplating Jerome Powell and the Federal Reserve’s challenge of tackling inflation without stifling growth in an economy that has become reliant on government stimulus, the lyrics of one of their well-known songs, “Deal,” seem relevant. Meanwhile, we’re grateful for your trust in us. Please do not hesitate to reach out to us at any time:

Since it costs a lot to win

And even more to lose

You and me bound to spend some time

Wondering what to choose

Goes to show, you don’t ever know

Watch each card you play and play it slow

Wait until that deal come round

Don’t you let that deal go down, no, no

I’ve been gambling here abouts

For ten good solid years

If I told you all that went down

It would burn off both your ears

Since you poured the wine for me

And tightened up my shoes

I hate to leave you sitting there

Composing lonesome blues

Wait until that deal come round

Don’t you let that deal go down

Click here to download the PDF.

For more information, please reach out to:

Burke Koonce III

Investment Strategist

bkoonce@trustcompanyofthesouth.com

Daniel L. Tolomay, CFA

Chief Investment Officer

dtolomay@trustcompanyofthesouth.com

This communication is for informational purposes only and should not be used for any other purpose, as it does not constitute a recommendation or solicitation of the purchase or sale of any security or of any investment services. Some information referenced in this memo is generated by independent, third parties that are believed but not guaranteed to be reliable. Opinions expressed herein are subject to change without notice. These materials are not intended to be tax or legal advice, and readers are encouraged to consult with their own legal, tax, and investment advisors before implementing any financial strategy.