April 11, 2023

“That Will Play All Day.”

There is practically an endless supply of overused expressions that can be used to describe various situations that may occur on the golf course. Some are more apt than others, and of course, many are unprintable. Some are so hackneyed that they are only used in jest or to be ironic. Even so, this is Masters week, and with azaleas and green fairways on the brain while writing this market letter about the first quarter of 2023, I could not help but think “there are no photographs on the scorecard.”

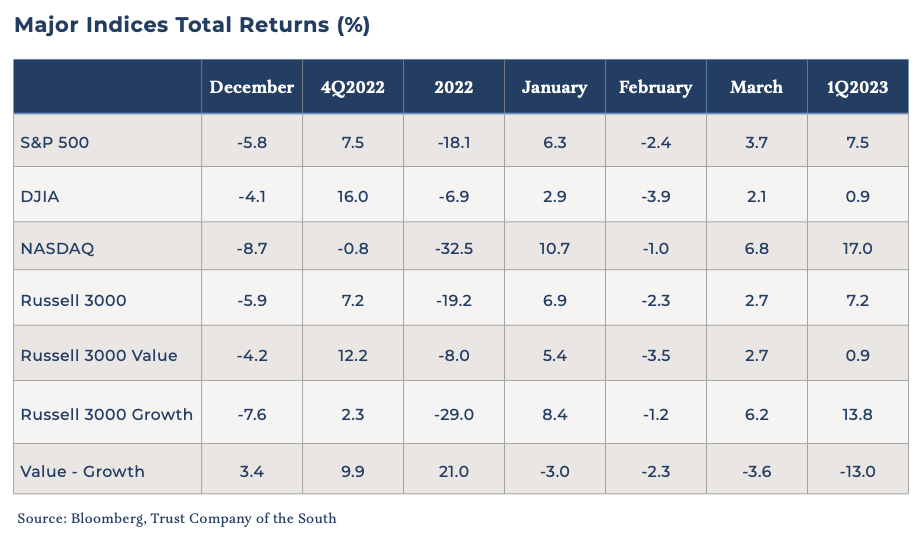

Yes, it would be difficult to conclude from looking at the first quarter scorecard that we had experienced three bank failures in the United States and seen the forced marriage of two large Swiss banks. The safety of the banking system was called into question, yet here we are with the S&P 500 up 7.5 percent for the quarter. The tech-centric NASDAQ was up 17% for the quarter, and the DJIA ended net positive. If Mr. Market were a golfer, he hooked his drive into the woods on the left, but his ball ricocheted off a tree back into the fairway. He then proceeded to skull his second shot thin into a bunker. However, on the third shot, Mr. Market, now breathing heavily and beginning to perspire, catches the ball thin again, and the ball comes screaming out of the sand headed for the pond. However, it hits the flag and somehow drops in the hole for a birdie. That’s pretty much what we just saw in the markets.

Now, of course, this round can still go a lot of different ways. Good fortune is a wonderful thing, and this golfer now has a nice story to tell. He can finish his round as the net beneficiary of some good luck. On the other hand, another quite logical conclusion given what we’ve seen, is that this fellow isn’t a very good golfer, and his luck will eventually run out.

Even so, there is one major difference though between the journey of a golfer and the journey of Mr. Market. Golfers may have benevolent monkeys in the trees looking out for them, but Mr. Market has the Federal Reserve. The Fed can be quite an effective caddy.

“We brother-in-law-ed it pretty well.”

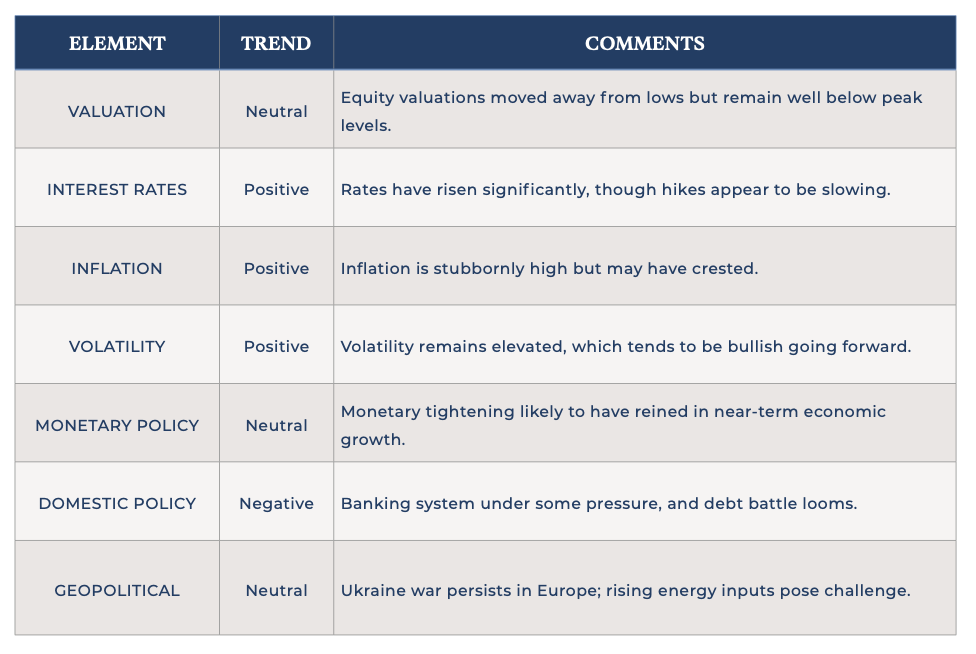

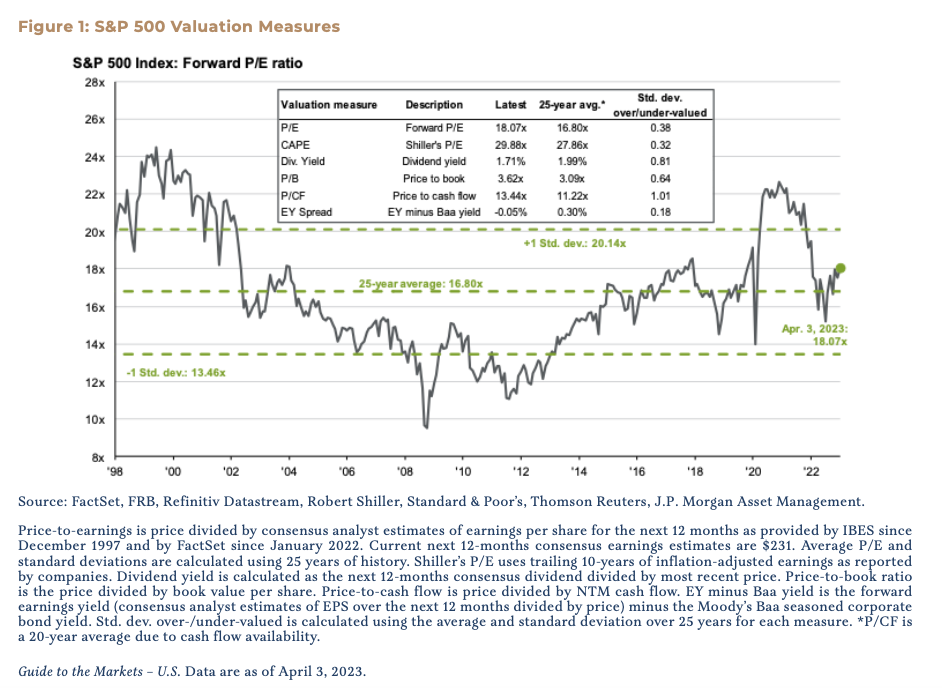

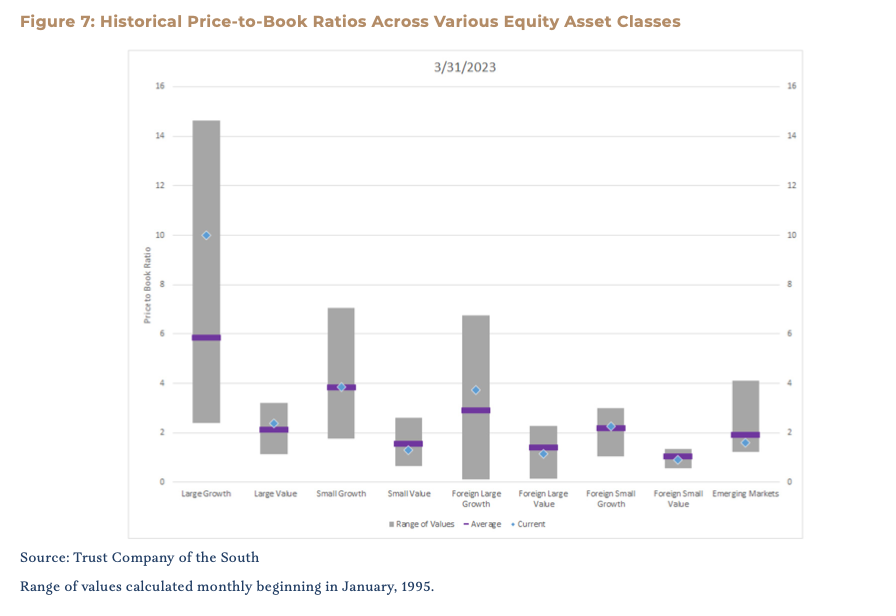

Equity valuations are still well off their late 2021 highs, but they crept back up again during the quarter and are now slightly above long-term averages. The price/earnings ratio on the S&P 500 has exceeded 18x forward earnings estimates, above the 25-year average of 16.8x. Because this environment tends to draw comparisons to the early 2000s, with the economy trying to shake off an easy-money hangover, it’s worth noting that 18x is comfortably below where the market was during its three-year swoon from 2000 through 2002.

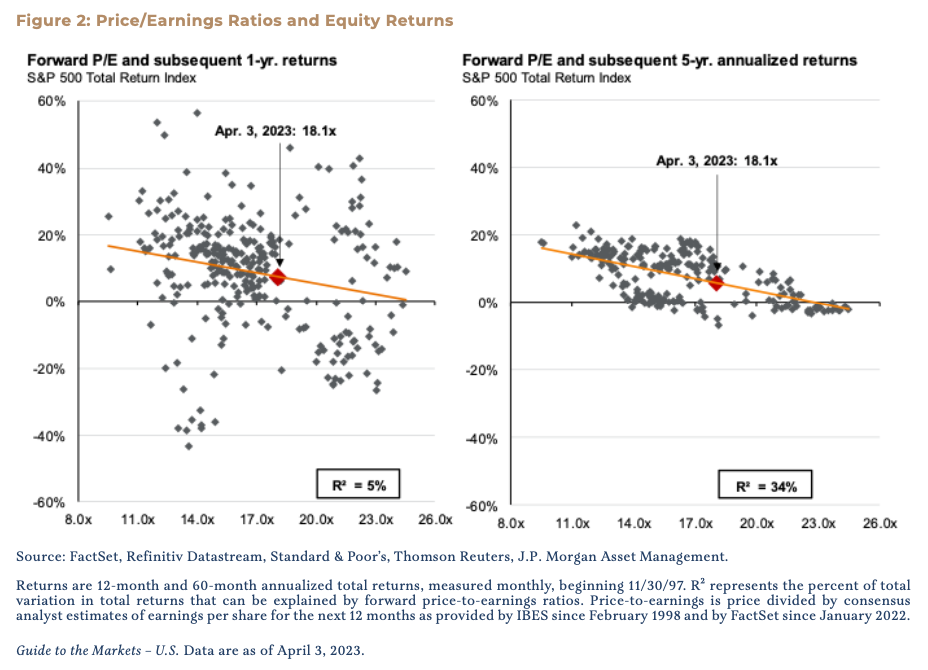

Even so, higher valuations mathematically pose a hindrance to future returns. While the relationship between valuation and subsequent returns is not necessarily obvious over a one-year period, as the chart below shows, it is visible over a five-year period. Five-year annualized returns from these levels ought to be positive, but perhaps not historically powerful.

So, why are valuations rising even as clouds of uncertainty gather on the economic horizon? From our perspective, the market’s expectations about the future Fed actions are key. The Fed might not be able to throw a golf ball back into the fairway, but, like a good “brother-in-law,” it can be a powerful partner, carding a par, or at least a net par, when one’s own ball is at the bottom of the pond or lost in woods.

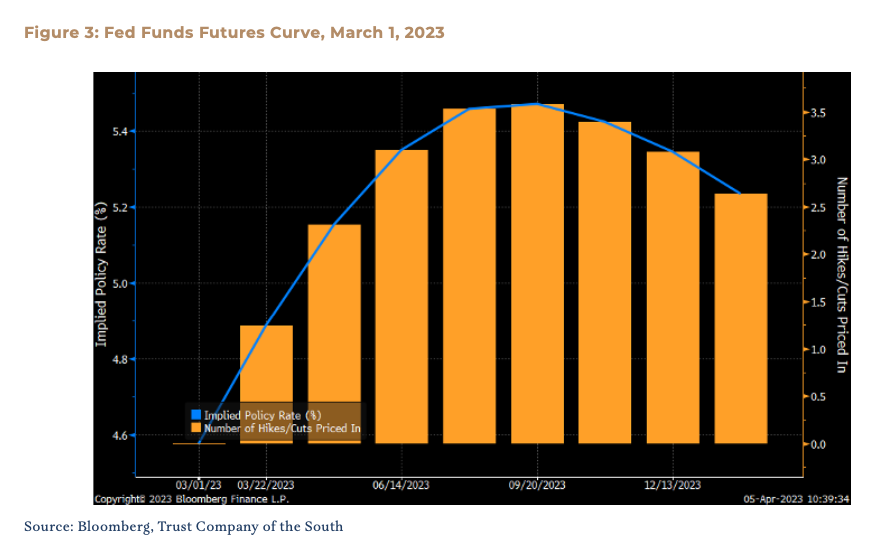

Prior to this most recent financial unpleasantness, the futures market for the Fed funds rate had predicted that interest rates would continue to move higher throughout the year, even into next year, owing to persistent inflation and supported by strong economic growth data.

The chart below illustrates what the market was expecting on March 1, including four more rate hikes and the implied Fed funds rate topping out at about 5.5%:

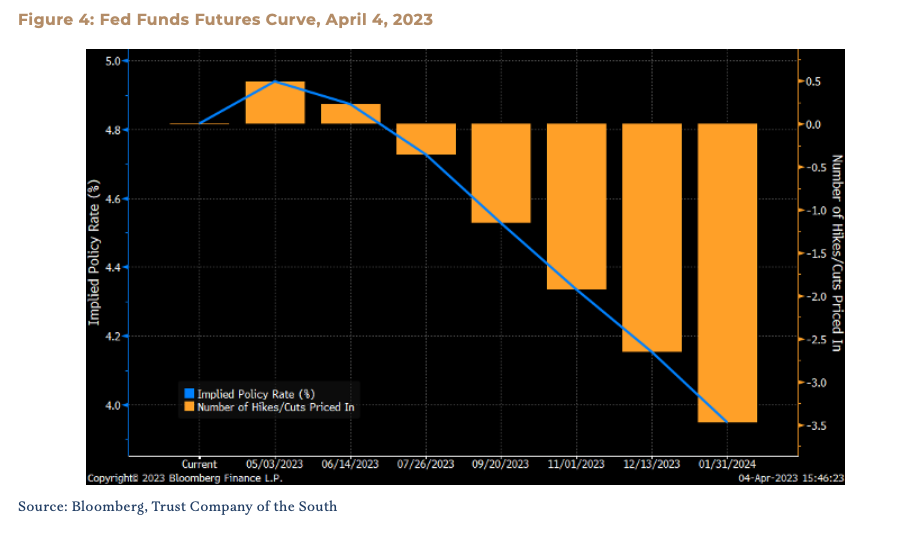

Save one errant swing and the whole round in danger of becoming a true calamity, the market immediately looked to Jay “Tiger” Powell to come in and save the day. This is what the Fed futures curve looks like this week:

The market is now predicting that there is less than a 50 percent chance the Fed will raise rates even 25 basis points more. Suddenly, it seems, the Fed may be a lot more market-friendly – a good caddy, indeed.

“Winter Rules.”

This certainly does not mean that the market’s prospects are guaranteed to be rosy. After all, this newly accommodative stance merely reflects that the tighter financial conditions, that Fed has been trying to engineer for more than a year, have finally arrived. Regrettably, the shareholders of Silicon Valley Bank, Silvergate Capital and Signature Bank can each attest to that. The playing conditions have become more difficult for most companies, and there will almost certainly be additional bouts of credit concerns, Broadly speaking, the Fed is again allowing investors to “lift, clean and place.”

“Green has a false front.”

In golf, there’s a particularly maddening phenomenon known as a green with a false front. Due to a diabolical combination of topography and groundskeeping, a golfer – doomed, wretched soul that he is – is led to believe he has hit a great shot onto the front of the green, only to watch the ball slowly, then with gathering speed, roll off the green and deposit itself into the fairway. There is a case to be made that this first quarter rally is a false front. This is because the lion’s share of the rally was in the largest stocks. One study (by Strategas Research) indicated that ten stocks accounted for 90 percent of the rally in the S&P 500, which is market-weighted. These mega-cap stocks have meaningfully outperformed the broader markets, perhaps as investors sought the perceived relative safety of these companies, which have lower debt and above-average growth prospects. With such a narrow rally, we should likely not start counting our score before we get to the turn, and stay cognizant of the hazards on the course.

The sudden convulsions seen in the banking system seemed to stem from several sources. Yes, SVB could be accused of having a portfolio with a huge duration mismatch, but after years of low interest rates, many banks do, which is the problem. In a world where investors can move vast sums of money even from mobile devices, perhaps spooked by something they’ve read on social media, it’s clear that insolvency is a greater risk than regulators had understood. Compounding the danger is the apparent phenomenon that many depositors, in the process of checking the safety of their deposits, figured out just how much they were giving up. They had been keeping cash in safe, but technically uninsured, accounts and not just buying treasuries, which were both safer and higher-yielding. Finally, there’s the matter of what was going on among the SVB customer base. From appearances, the giant spigot of cash that had flooded the venture capital market with cash for years has been turned off. Part of SVB’s problem was that the bank’s customers were simply drawing down their cash balances, not originally because they had the least bit of concern about SVB, but because they simply needed the dough to make payroll. It doesn’t take a great deal of imagination to contemplate an economy in which there will be customers of other banks who will soon find themselves short of cash. This would perhaps be the result of loans coming due and being unable to refinance at higher interest rates. Under these circumstances, why would anyone willingly expose themselves to smaller, regional banks unless there was some additional level of insurance, explicit or implicit, provided? Well, there historically hasn’t been, which is why the deposit backstop created by the Fed and the Treasury proved necessary.

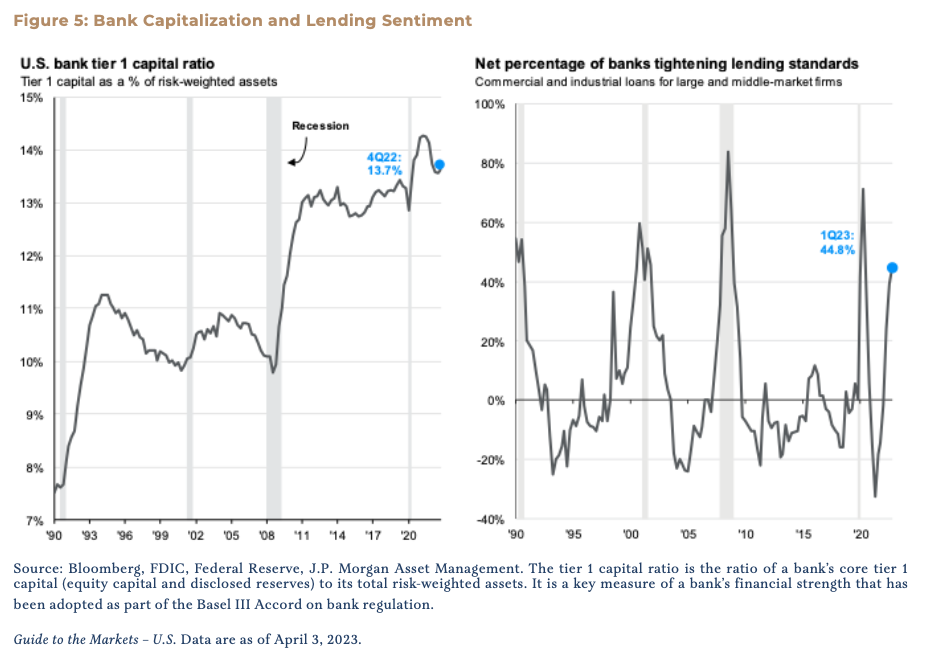

The good news is that overall bank capital is historically strong. This is a far cry from 2008. The bad news is that depositors don’t care about capital ratios if they feel like their deposits are in danger for any reason. Whether newly-tightened lending standards, as the next chart illustrates, are good news or bad news is perhaps a matter of perspective.

“There’s a lot of golf left to play.”

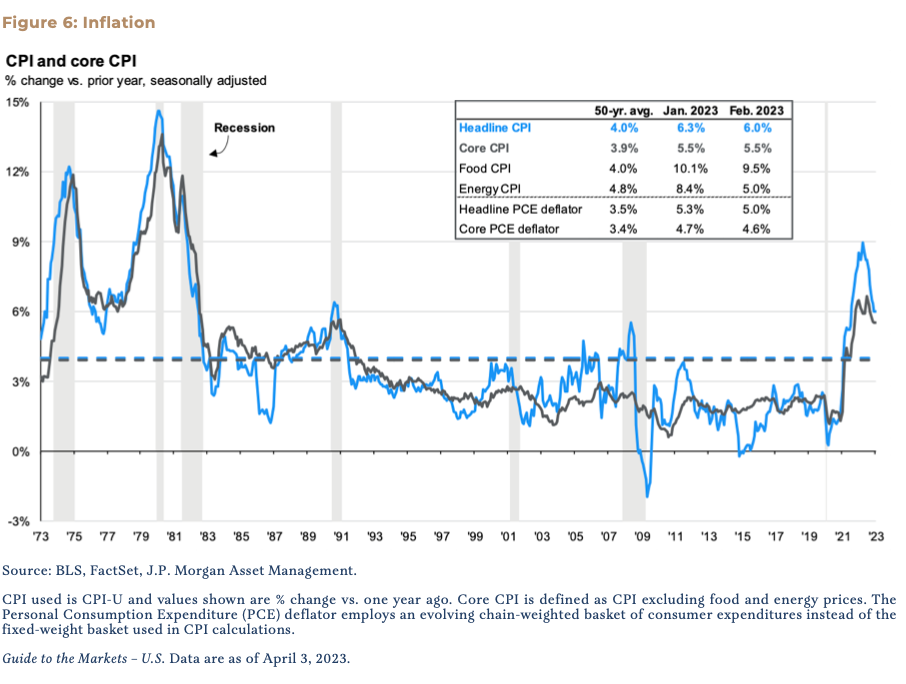

On the other hand, the market remains efficient – not perfectly efficient, but reasonably so over the long-term. Inflation first started showing signs of cooling late last fall which is when the market bottomed. Falling inflation is good news for everyone, and the Dow seemed to sniff it out first, rallying 16% during the fourth quarter.

This past quarter, it was tech’s turn. The mega-cap names doing well so far this year are the same ones that were left for dead last year. Perhaps it’s not so strange for some of the largest companies in the world to see their stock prices outperform during periods of financial duress because of their low leverage. That said, we remain of the view that these mega-cap stocks that fuel returns in large-cap funds and strategies are still priced well north of historical averages. They will probably be less likely to reward investors over the long term vs. other opportunities.

“You’re pressed.”

For the first time since last summer, before the Fed really made clear its willingness to ratchet up interest rates to levels unseen in years, growth outperformed value during the quarter. Moreover, growth outperformed by quite a lot. The Russell 3000 Growth Index outperformed its value counterpart by 1,300 basis points. However, the outperformance was mainly among the tech names. Comparing the Russell 2000 growth and value indices, which do not include the 1,000 largest stocks, growth’s outperformance was only 660 basis points. This proved to still be strong, but it does suggest there was a flight-to-safety component to this rally. Safety and long-term returns belong on opposite ends of the spectrum. Over the long-term, the evidence suggests that having a value tilt is a good way to bet.

Ryder Cup

Outside of the Masters, the Ryder Cup, when a team of U.S. golfers takes on a team of European golfers, is perhaps golf’s most exciting event. Held only biennially, the stakes are high. One side or another can hold the cup for long periods of time.

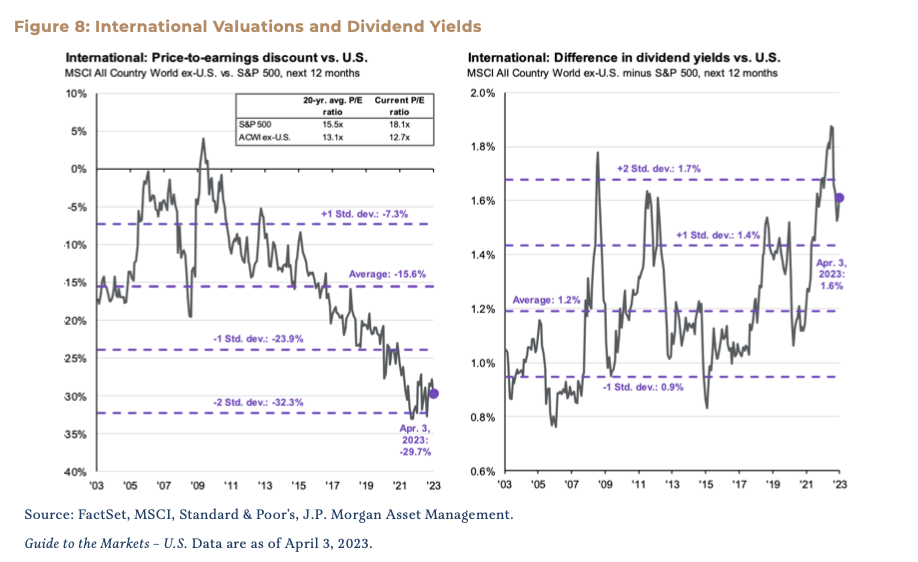

Similarly, last year marked the end of 14 years of U.S. dominance over the rest of the world in equity returns. A strong finish to the year, boosted by falling long-term interest rates in the U.S., was a factor, but the real attraction of continuing to allocate to international is valuation. Valuations abroad remain at historically attractive levels compared to U.S. stocks. International returns are again outpacing U.S. returns year-to-date. With the market now expecting rates to fall this year, which typically means a weaker USD, perhaps the international team is the way to bet again.

“In the leather.”

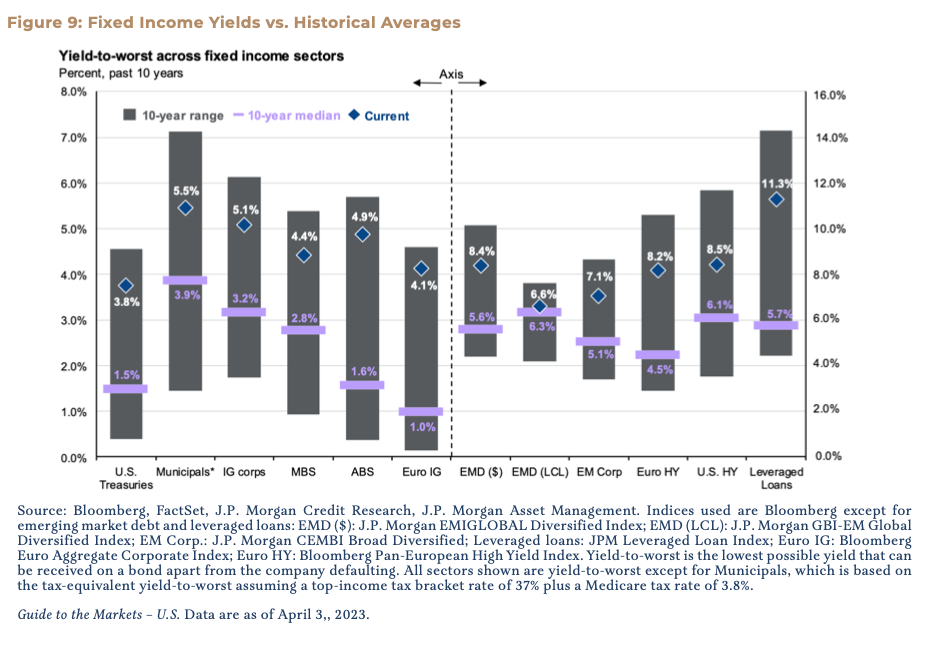

For years, fixed income returns have been anemic due to the extremely accommodative stance among central banks. Investors were seemingly forced into riskier assets to earn acceptable economic returns. Rising interest rates have made bonds more attractive, and though many fixed-income investors are sitting on mark-to-market losses from last year, new investments in extremely short-term securities are earning positive real returns.

“What’s the yardage? What’s the wind doing? Can you give me a read?”

These course conditions seem challenging indeed. We have crosswinds in the form of a hopefully, newly-supportive Fed amid a cooling economy. Inflation may have decelerated, however this is no time to decelerate attempting a new swing. This is perhaps the most anticipated economic slowdown in modern history, and that does not mean there won’t be surprises, as the events of the first quarter make clear. We know what the evidence suggests about where to find premiums in the markets over the long term, and that’s how we’ll continue play the course.

“If nothing is so useless as an ivory tower academic theory that goes unused, nothing is so very practical as the theory that works.” — David Swensen

Click here to download the PDF.

For more information, please reach out to:

Burke Koonce III

Investment Strategist

bkoonce@trustcompanyofthesouth.com

Daniel L. Tolomay, CFA

Chief Investment Officer

dtolomay@trustcompanyofthesouth.com

This communication is for informational purposes only and should not be used for any other purpose, as it does not constitute a recommendation or solicitation of the purchase or sale of any security or of any investment services. Some information referenced in this memo is generated by independent, third parties that are believed but not guaranteed to be reliable. Opinions expressed herein are subject to change without notice. These materials are not intended to be tax or legal advice, and readers are encouraged to consult with their own legal, tax, and investment advisors before implementing any financial strategy.