Ah, the Twenties. An era remembered for breaking tradition, for flouting social norms, for rapid economic growth, and, of course, for Roaring Kitty. Yes, we are talking about 2024, not 1924, although one could be forgiven for confusing the two. Roaring Kitty, also known as Keith Gill, has burst back onto the investing scene, screenshotting his positions and tweeting out memes and moving markets.

Roaring Kitty of course is Gill’s handle on YouTube and Twitter (or X, depending on one’s worldview). Gill rode a meteor to fame in early 2021 when his Reddit musings ignited a trading frenzy in shares of GameStop (GME), which fueled a perceived short squeeze in GME shares and in a handful of other so-called meme stocks, including AMC, the movie theater chain. Back then, Gill published a screenshot of his $53,000 long position in GameStop and went online to explain his logic through both fundamental and technical analysis. As his videos went viral and GME stock went from $5 to $483 (briefly), Roaring Kitty’s position became worth almost $50 million. Soon, of course, GME was a single-digit stock again (although it did split 4:1 in 2022) and Gill’s social media accounts went dark.

Well, last month, Roaring Kitty was back, screenshotting positions, posting memes and sending GME and AMC to the moon. Good for Mr. Kitty, I suppose. However, let’s not overlook the real-world impact he has. AMC used the feeding frenzy in its shares to raise $250 million. GameStop raised $1 billion, which it will use to pay down debt and generally buy itself more time to figure out how to survive in an era in which video gamers use this amazing technology called the internet to download video games instead of going to the mall. Perfectly good dollars left the brokerage accounts of lots and lots of people and arrived in the corporate coffers of these two companies where they will be spent, and of course the shares of both companies are now well off their monthly highs.

That is the kind of market we are in, folks. Anyone who believes markets today are perfectly efficient vehicles where rational investors set prices is not paying attention. What’s fascinating is that Roaring Kitty’s logic and thesis originally had nothing to do with “sticking it to the man” or becoming a so-called meme lord; he published his models and to his considerable credit, he had done a lot of work. He could have never predicted what followed—a free-for-all that metastasized into a phenomenon that transcended economics. But that was the market we were in during January 2021, and evidently, at least for a while, that’s the kind of market we were in this May.

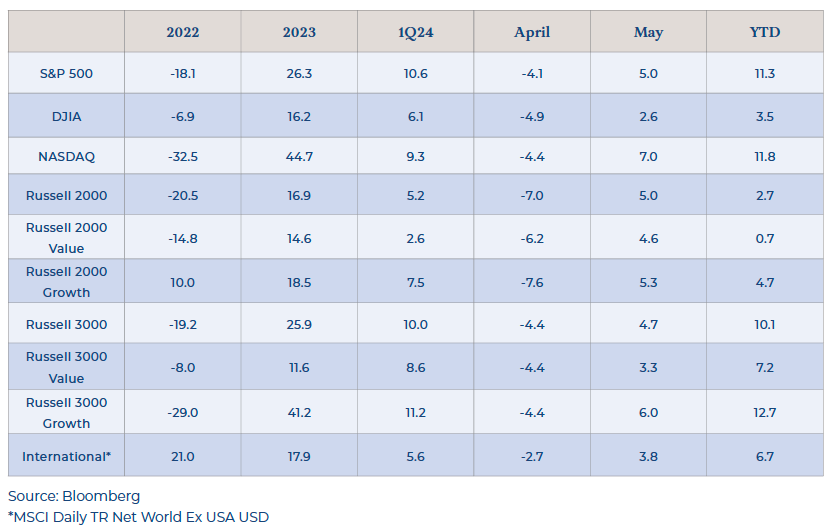

Financial markets were buoyant last month, with the S&P 500 up 5%, the Russell 3000 up 4.7%, and the tech-laden NASDAQ up 7%. This marked a sharp reversal from April’s swoon. What drove this sudden fit of bullishness? It’s a fool’s errand of course to attempt to explain every tick in the market, but bond yields fell during the month, as slightly softer economic data gave investors new hope that interest rates would begin coming down before the end of the year. Again, this is the exact opposite of what seemed to drive prices down in April. We closed last month’s letter with an appeal for “darling buds of May” to assuage the effects of “the cruelest month.” Thank you, Mr. Market!

Mr. Market has gone off his meds and is experiencing an unusually euphoric episode. Of course, this was preceded just weeks ago by an episode of unusual gloominess. Such is the life of Mr. Market. He actually is pretty good over time at figuring out what businesses are worth, but he is prone to manic fits.

This is why we normally avoid following short-term trends or “episodes.” It’s not that the market is short-term efficient—it’s not. But it’s good practice to invest as if it were. That’s one reason why a GameStop or an AMC would get booted out of our consideration. They’re stocks—expensive stocks—and while they might be expected to earn normal stock returns in the long run, the lofty prices paid for those returns will meaningfully impact them.

So, we’re happy for Roaring Kitty. I hope he screenshots and memes his way into an early and enjoyable retirement and manages to stay out of jail, because there’s little doubt there are lots of unsavory opportunities available to him. Meanwhile, the rest of us will keep trying to buy good businesses at attractive prices and use time to our advantage instead of attempting to be overly clever or lucky. Because we don’t know when the Roaring Twenties will end. Only that they always do.

Click Here to Download the PDF.

For more information, please reach out to:

Burke Koonce III

Investment Strategist

bkoonce@trustcompanyofthesouth.com

Daniel L. Tolomay, CFA

Chief Investment Officer

dtolomay@trustcompanyofthesouth.com

This communication is for informational purposes only and should not be used for any other purpose, as it does not constitute a recommendation or solicitation of the purchase or sale of any security or of any investment services. Some information referenced in this memo is generated by independent, third parties that are believed but not guaranteed to be reliable. Opinions expressed herein are subject to change without notice. These materials are not intended to be tax or legal advice, and readers are encouraged to consult with their own legal, tax, and investment advisors before implementing any financial strategy.