Inboxes have been especially full lately. The contents are not e-mails from worried clients but from other members of the financial services industry. Everyone, it seems, has thoughts on the Coronavirus and market volatility. And this is not new. After the crisis in 2008, any blip in the markets generates a frenzy of commentary.

Such reactions set a tough precedent. Reacting to every decline runs the risk of “crying wolf” and having the message passed over. Sporadic publications may cause readers to wonder if one event is more or less serious than another. Lastly, failure to address each price decline may be perceived as being dismissive or aloof.

Hopefully, the commentary below provides some perspective on recent events. We do not (nor does anyone else) possess any unique insight that will tell us how long this will last or what the magnitude will be. What we do know is that we expect volatility from equity markets. Higher risk equates to higher expected returns. We are aware of the situation and view it as a normal component of investing in stocks.

The headlines pertaining to the spread of the Coronavirus around the globe and the increase in the number of infected are unsettling. Of primary concern is the health and well-being of people around the world. We remain hopeful that coordinated global containment efforts and common sense precautions will slow and eventually cease the outbreak.

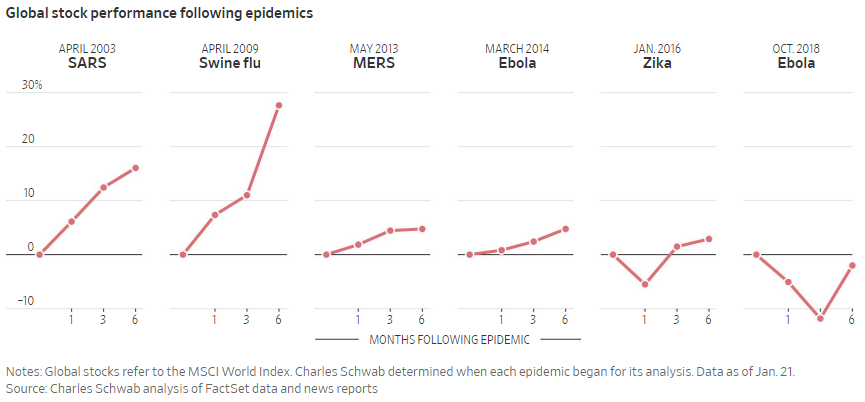

Of secondary concern is the impact the epidemic is having on financial markets. Is it different this time? Yes, this time it’s Coronavirus. Last time it was Ebola. Before that Zika. The following graphic from The Wall Street Journal summarizes market reactions to recent epidemics.

It is not our intent to diminish any of these events. Rather, we seek to highlight the fact that this type of event has happened before and markets reacted the same way – by processing information. The recent volatility can be unnerving, but it proves that markets are working. Declines occur when market participants reassess their views of the future. Governments, companies, and individuals are all trying to figure out what is next. These reviews translate into uncertainty.

Unknowns are risky. Consider, for example, that you are buying a used car. Despite your diligent research, there is still an element of uncertainty. What if it looks, sounds, and drives fine but there is an unseen issue? You may build in a margin of safety (via paying a lower price) to allow for something to go wrong (i.e. a needed repair). The same concept applies to stocks. When risk increases, higher returns are required for investors to bear that risk. Higher returns are achieved by paying lower prices for “risky” assets like stocks. Prices will settle at a level that provides a positive expected return for exposure to the perceived hazard.

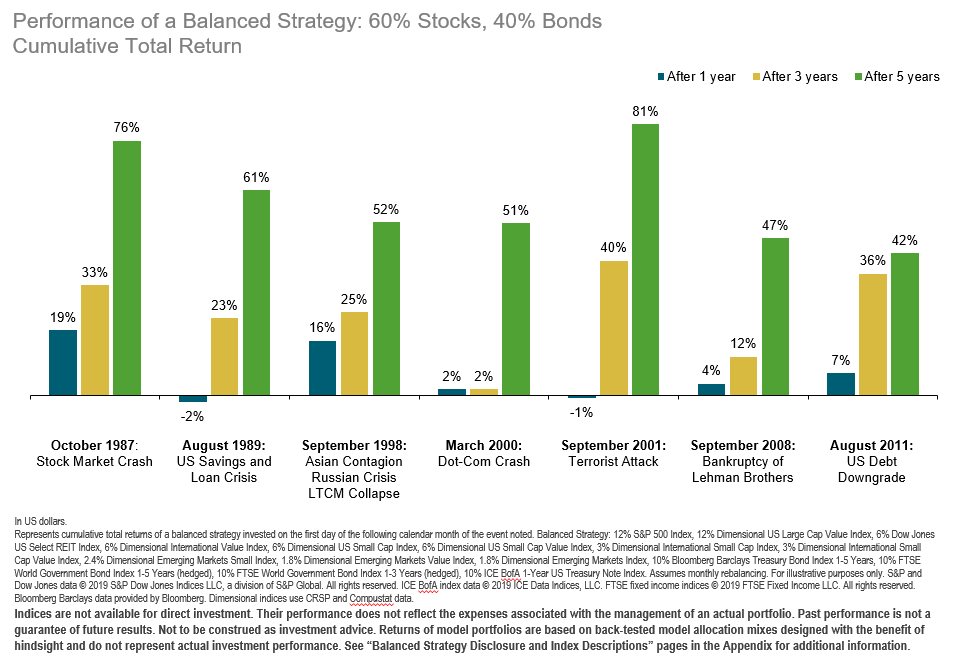

Every market stress is different in its duration and magnitude. But, looking at past events, we see that markets have rewarded investors for bearing risk.

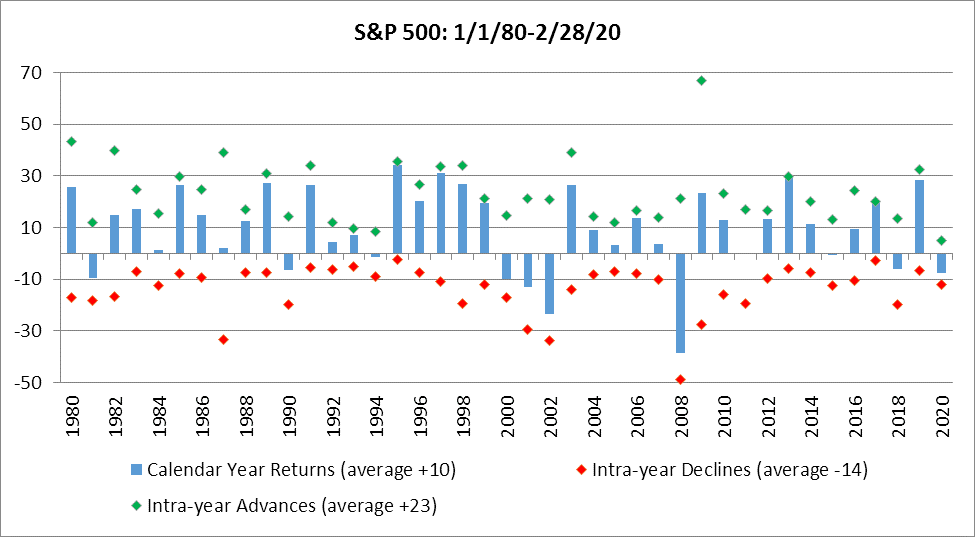

Perspective on historical volatility may help put the recent selloff in context. The chart below looks at the S&P 500 from 1980 through the end of February 2020 on an annual basis. Over that time, the average annual return (blue bars) has been about 10%. There has been quite a bit of variance around that average.

However, within any year the noise is louder but common. On average, the S&P saw an intra-year decline of -14%. And, to the upside, the average intra-year advance was +23%.

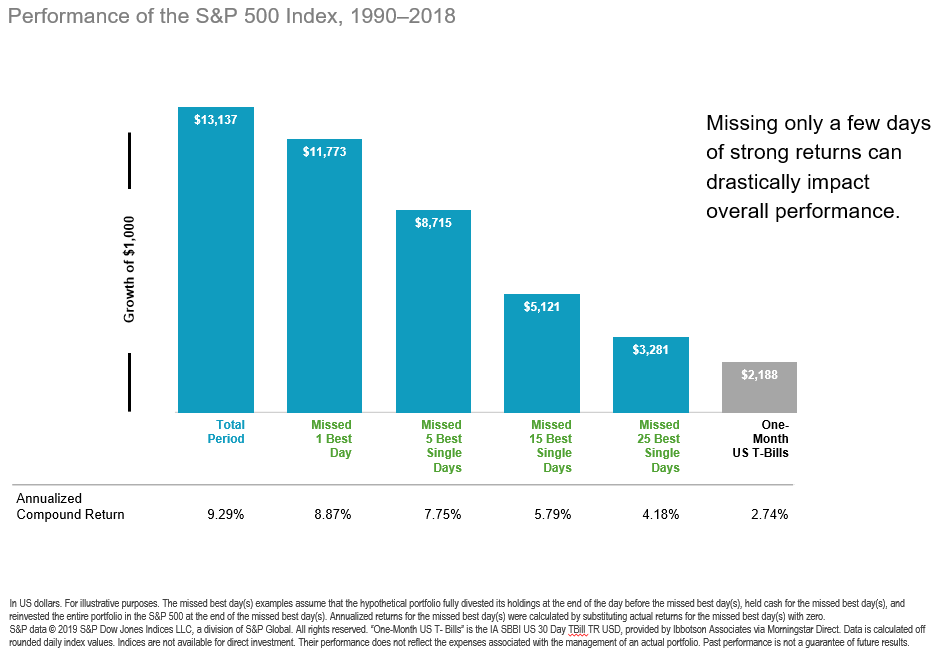

It may be tempting to try to miss those declines and capture those increases. Again, the data paints a sobering picture.

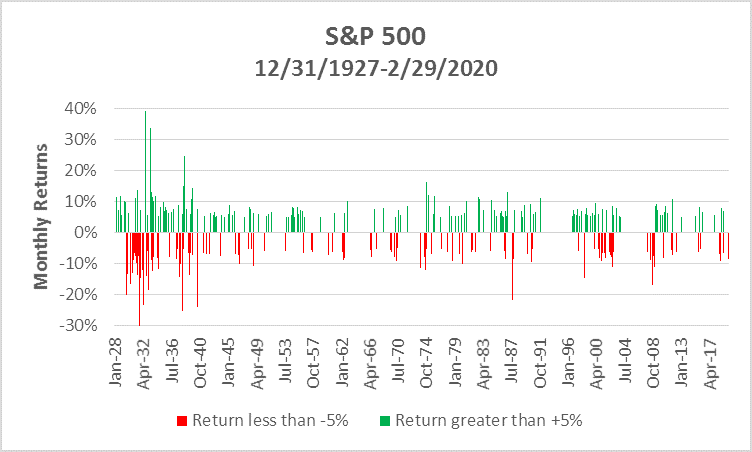

As we’ve seen in the past few weeks, volatility – both down and up – tend to occur together. So, an attempt to avoid big losses may very well mean missing big gains, too. And missing a few of those can be devastating.

Times like these can be stressful and you may feel helpless. So, what can you do?

1. Ask yourself if anything has changed with your personal situation that would merit a change to your asset allocation. If so, discuss with your advisor. If not, stay the course.

2. Avoid the risks that you can. For example, diversify your portfolio.

3. Control the controllable. Keep your investment costs down and more will stay in your pocket.

4. Have faith in markets to set prices at a fair level and provide a return commensurate with the risk being borne.

Please stay healthy and safe. If you have any questions, please let us know.