It was an ugly first half of 2022. The value of large US companies declined -20%. Small US companies fell a bit more at -23%. International developed markets shed -19% and international emerging markets dropped -18%. Phew.

Thank goodness for bonds. Except the bond market was down too. Domestic and international. Both were both off -10%. Cash was a relative bright spot in that it didn’t decline in value. But, with inflation numbers still coming in hot, cash’s paltry return won’t be enough for your money to grow fast enough to keep up with rising prices. So, what should be your next steps? It depends on where you’re going.

It’s always good to have an investment plan, but that’s especially true during trying times like these. An investment policy statement (IPS) is a document that spells out a portfolio’s objectives and constraints. Among the key considerations are: What is the return objective? What is the tolerance for risk? When will the funds be needed?

Generally speaking, the longer the time horizon, the greater the ability to tolerate risk/volatility. And, as risk and return are directly related, more volatility should mean a higher expected return. Below, three sample situations are presented and reviewed. As what has occurred in markets so far this year is behind us, decisions should be prospective, not reactive. However, recent events can provide some insight.

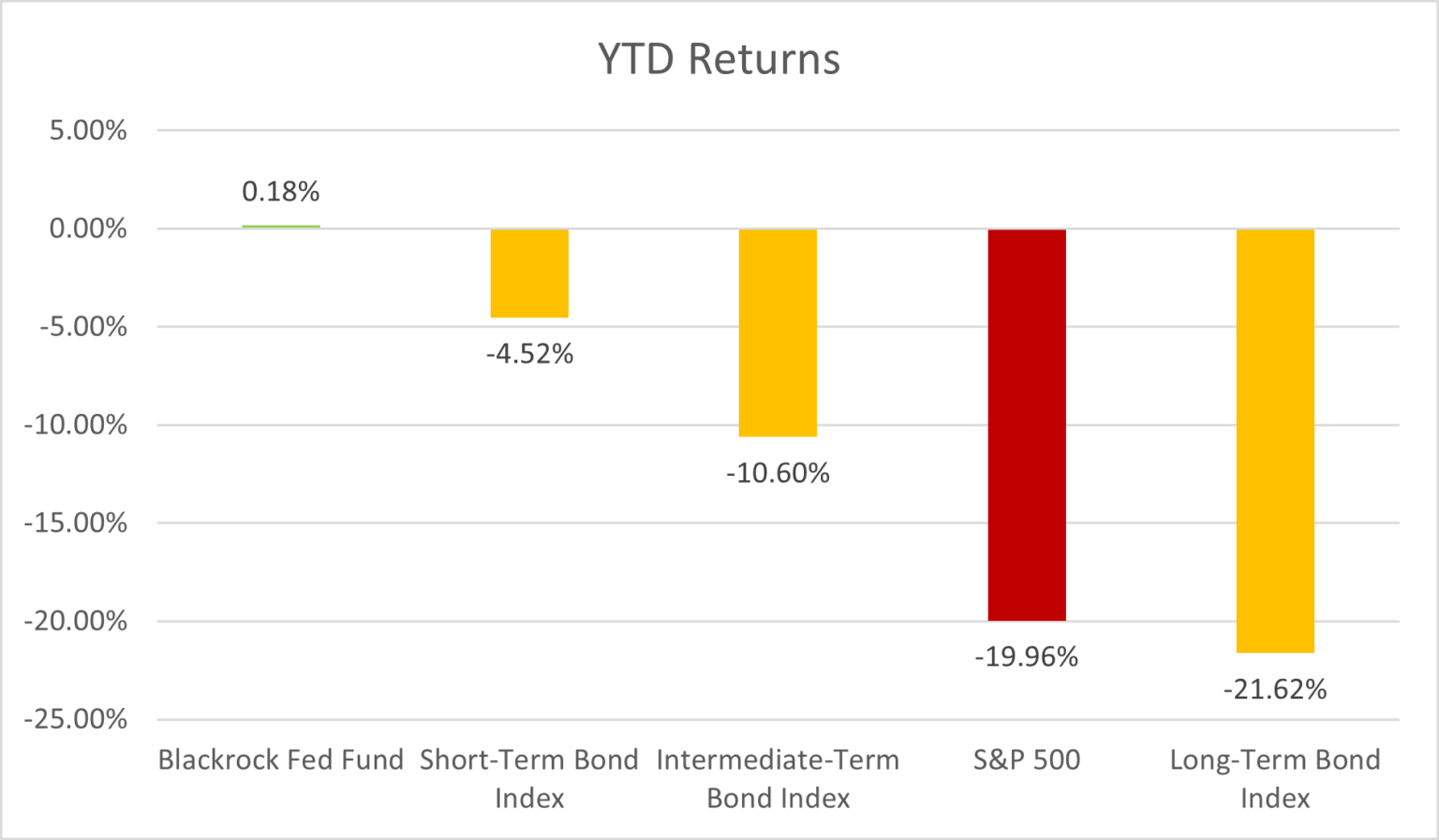

A short time horizon does not allow for volatility. That is intuitive as it pertains to stocks and their noisy near-term returns. However, bonds can be volatile, too. Below is a chart comparing year-to-date returns for Vanguard index funds that track different segments of the bond market to a money market fund and to stocks.

As can be seen in the chart, bonds were down across the board. Long bonds were down more than stocks. Many investors also were likely burned by reaching for yield in short- and intermediate-term bonds. Not only would a money market fund have avoided losses, but it would have benefitted from increases in interest rates as the Fed tightened monetary policy.

Principal protection is the goal for funds needed soon. While additional return would be great, the volatility that must be borne can cause more harm than good. If the account is short of its target value, swinging for the fences is not the answer. Delaying the target or adding more funds are the prudent actions.

An intermediate time horizon permits some volatility in a portfolio. It also introduces a new risk – inflation. Not only is the portfolio able to be more volatile, it needs to be in order to target a higher return to keep pace with rising prices over time. Again, stocks are likely to provide too uncertain of an outcome. But what have bond returns looked like over time?

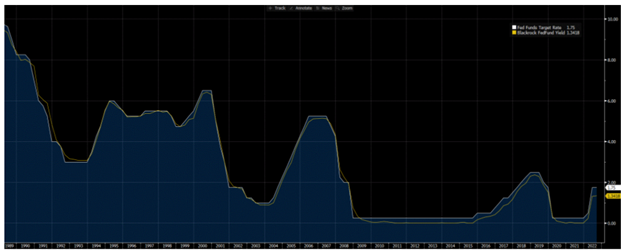

As yields go up, bond prices go down. Investors saw plenty of this in the first six months of 2022, and the cause was concern about inflation. But rising interest rates are a double-edged sword. The other impact on bonds as yields rise is that interest payments also rise. This takes time to play out, but, over time, as coupon payments are received and bonds mature, that new cash is reinvested at new, higher rates.

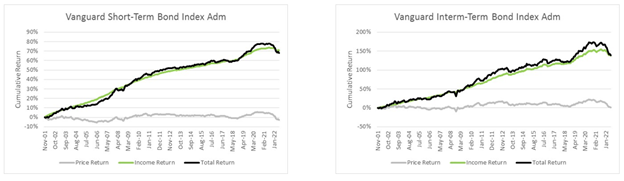

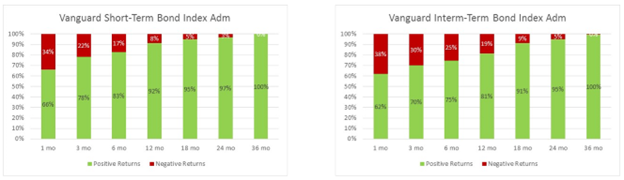

Consider the Short- and Intermediate-Term bond funds again. Below, the charts show that the driver of bond returns is income, not price changes. Between issuance and maturity, a bond’s price will fluctuate. Absent a default, however, a bond’s value will move to face value at the end of its life.

As higher income continues to offset price declines, the likelihood of having a positive total return goes up over time.

There are a couple other takeaways from the above charts. First, a “term premium” exists. That is – the longer the term of a bond, the more time there is that an investor’s money is at risk and the higher the reward should be. (Note the scale of the line graphs above.) Second, risk and return are related. In the bar graphs, the likelihood of a negative return in intermediate-term bonds is higher than it is in short-term bonds. A higher return is expected; however, negative returns (risk) have been more common than in short-term bonds. It may take longer for intermediate-term bonds to recover from an interest rate spike.

A lengthy time horizon has the greatest ability to tolerate volatility. Longer investment periods provide more opportunities to recover from temporary losses. As more risk can be borne, more return can be sought. A return in excess of inflation can be spent to support a current need (ex. a foundation, endowment, or retiree) or it can provide for portfolio growth (ex. saving for retirement).

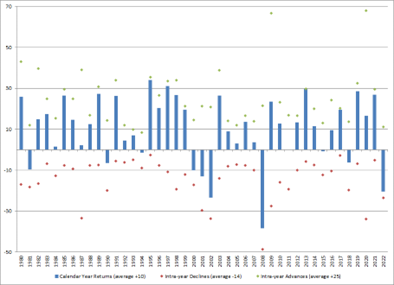

Stocks can and do have a role in account with lots of time on the clock. The recent pullback in equities is not uncommon. As the chart below (which we’ve dubbed “The Annual End of the World”) shows, intra-year declines in the S&P 500 are not uncommon. In fact, on average, there has been an intra-year decline of -14%. (This year, so far, it’s been -24% from 1/3 to 6/16.) There has also been, on average, an intra-year advance of +25%. (Did you know that the market was up +11% from 3/8 to 3/29?)

Again, risk and return are related. Just as bonds have returned more than cash with more volatility, so too have stocks returned a higher number than bonds but with a bumpier ride. Mixing bonds in with stocks can make that ride smoother.

Nobody knows what’s next for COVID, Ukraine, Inflation, the Fed, or if we’re headed for a recession. What is known is that these risks are well understood by global investors. Those market participants, motivated by a desire to profit, have positioned their portfolios to reflect their expectations. In aggregate, this collective wisdom drives prices of securities to fair values. The prices, in turn, set expected returns commensurate with the risk of the investment.

Rather than focus on the headlines, which we cannot control, it is more productive to revisit one’s personal situation, which can be managed. Does the asset mix match the time horizon and risk tolerance? From there, a range of returns can be estimated. If the portfolio’s contents do not match one’s situation, changes can be made.

Think of specialized labor. Let markets do what they do best – process information, set prices, and future returns. Investors should do what they do best – ensure the asset allocation matches their needs, not their emotions.

As Chief Investment Officer, Dan is responsible for developing Trust Company’s investment strategy and managing client portfolios.