My sons like to play with dominoes. Specifically, they like to stand them up in rows, push the first one over, and then watch them fall one by one. The design, which is entertaining to devise and laborious to build, is satisfying to watch as it unfolds as planned. Things don’t always go as concocted, though. Sometimes a shaky hand sets the process off prematurely leading to an incomplete sequence. A fully deployed set of tiles may fail to deploy as was imagined. It’s an interesting analogy in today’s bond market. What seems like a clear sequence of events leads to assumptions about the future and how to react.

The pandemic has resulted in product shortages. The scarcity has pushed up prices. A lack of labor supply has caused employers to raise wages to entice workers to join their teams. These inflationary pressures have nudged up interest rates. Bond investors, who receive fixed payments, see the value of those payments eroded when prices rise. To adjust, they demand higher yields, which is achieved by paying lower bond prices.

At the same time, inflation forces the Federal Reserve into action to stabilize prices. The primary tool the Fed uses for this purpose is interest rate hikes. Increasing short-term rates provides an incentive to save and a disincentive to borrow and spend. The desired impact is to cool the economy down so that it doesn’t overheat.

For the three months ended February 2022, the 2-year US Treasury yield has increased 0.92% and the 10-year US Treasury has increased 0.40%. The bond market (as measured by Vanguard’s Total Bond Market Index fund) fell -4.26% during that time. With inflation still in the headlines and more potential increases in interest rates looming, what are prudent steps to take with a bond portfolio?

First, don’t just focus on the dominoes that failed. Look at what worked. The -4.26% return referenced above is only the price move. When income is included, the return improves to -2.48%.

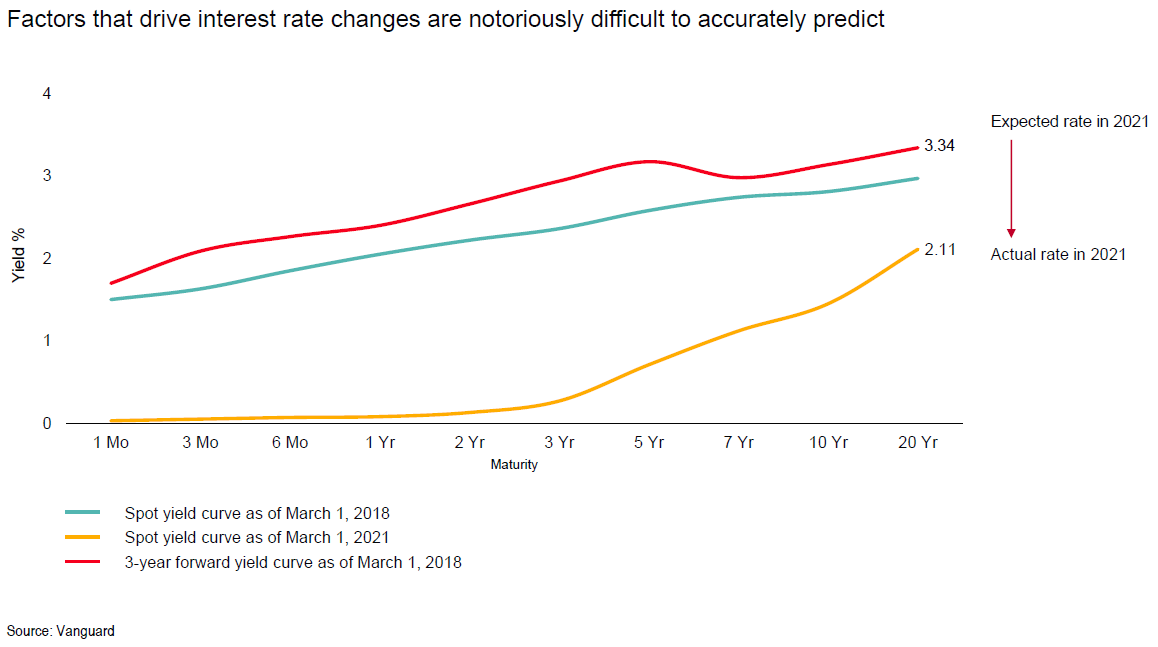

Next, remember the dominoes don’t always fall as planned. The consensus view is that interest rates will continue to rise. This was the case on March 1, 2018, too. The market’s expectation was that rates would increase from the blue line to the red line in 3 years. What actually transpired can be seen in the gold line.

As the chart below demonstrates, sometimes the dominoes are the victim of a false start; the plan for the grand launch fizzles out abruptly. Looking back 15 years to the Financial Crisis, there are multiple examples of what was perceived at the time to surely be the bottom for interest rates. Yields rose some, then fell again – in some cases even lower.

The argument is not that rates won’t rise. They likely will; however, it’s impossible to know how much, how quickly, and exactly how different maturities will be impacted. Additionally, with the risk of further coronavirus variants, escalating geopolitical tensions in Ukraine, or some other unknown crisis, there remains the chance of a “flight to quality” event. Such an event would see flows into bonds, a rise in bond prices, and a drop in yields. Or, inflation could end up being transitory, which would reduce inflation expectations and allow the Fed to be less aggressive. This would cap yields and support bond prices.

A domino cascade may go awry but it’s still fun; there’s a silver lining. Assuming rates do rise, what does it mean for bonds? That too is a mixed bag. The bad news is that the principal value of a bond will fall. The good news is income will rise.

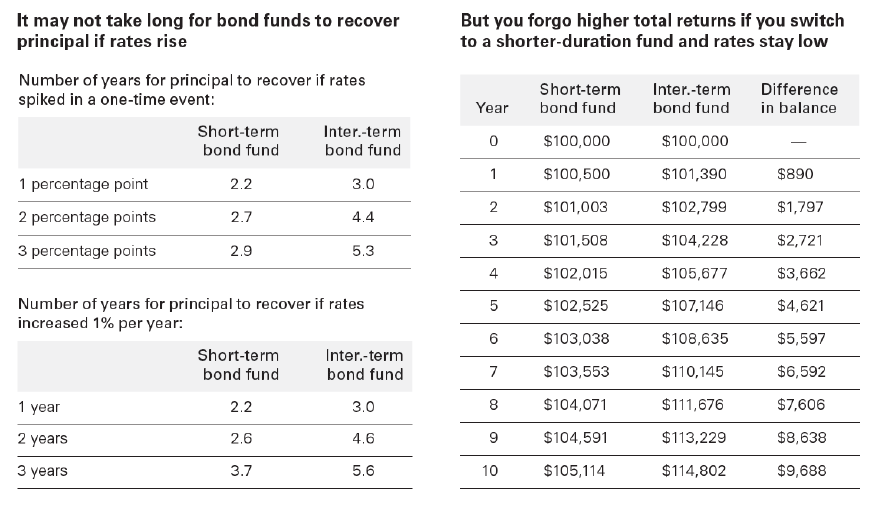

The extent of the price decline is determined by the bond’s duration, a measure of the timing of a bond’s cash flows and its sensitivity to interest rates. As a rule of thumb, a bond’s value will fall by its duration multiplied by the size of the rate increase. For example, a bond with a duration of 5 will decline by 5.0% for a 100 basis point (bp) or 1.00% jump in yields. (It’s important to note that – absent a default – the bond’s price will ultimately move to par at maturity.) Cash flows from interest payments and bond maturities can be reinvested at higher yields.

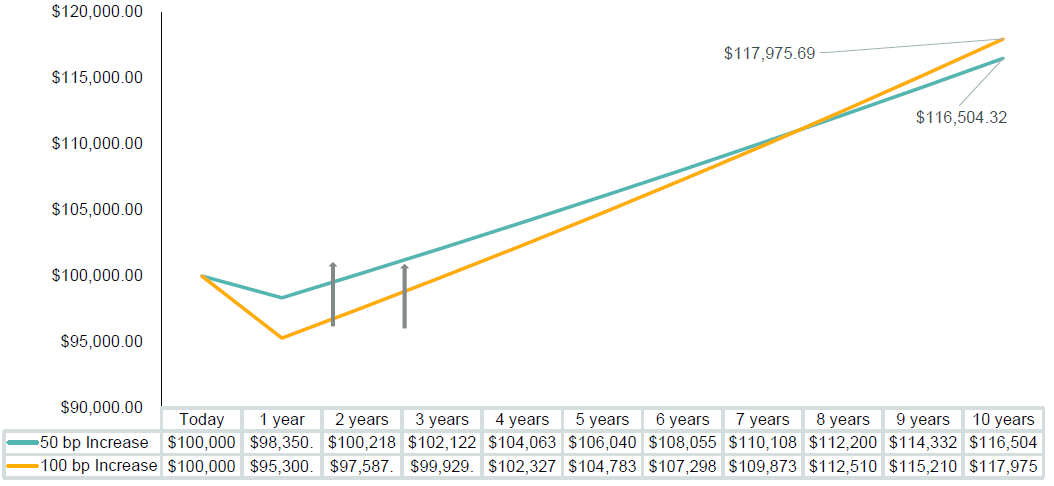

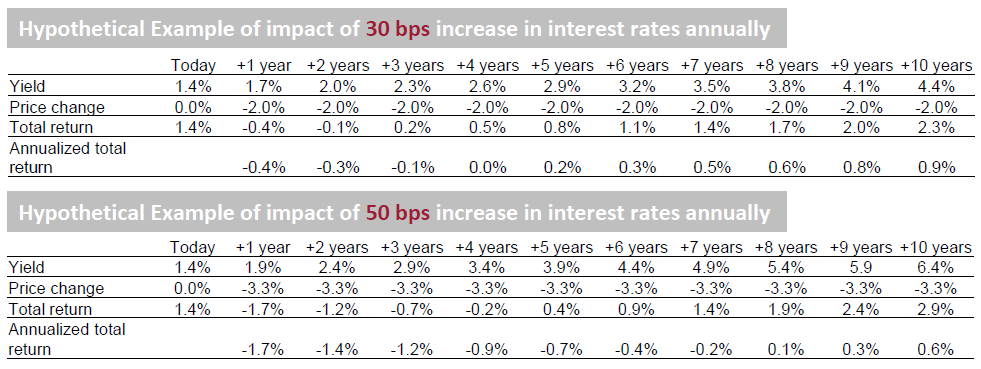

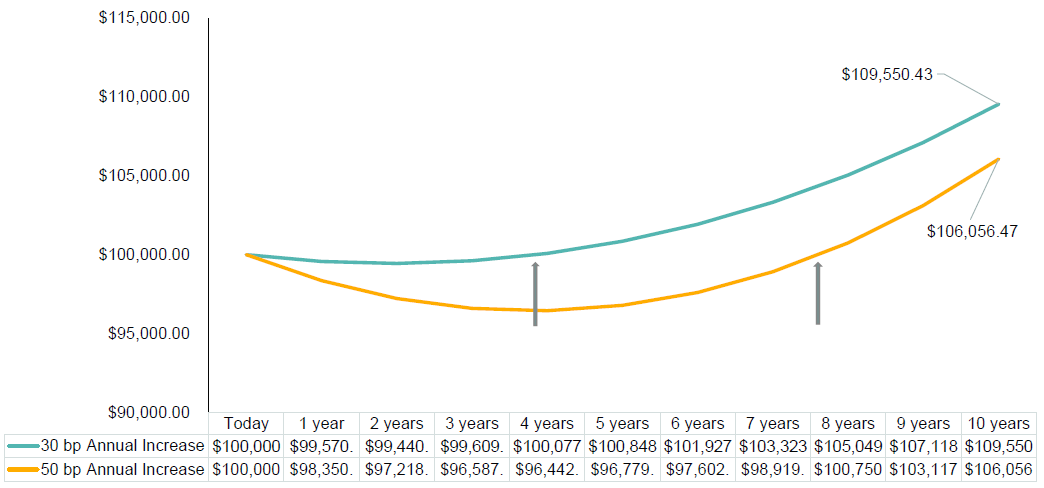

These forces can be seen at work in the examples below, which assume a 6.6 duration and a 1.4% beginning yield. The first set of illustrations assumes one-time jumps of 0.50% and 1.00% in yields. The second set shows annual hikes of 0.30% and 0.50%. As the price change rows show in the +1 year columns, there is a negative price change. The yield rows reflect the higher income starting at the same time, though.

One Time Shock to Rates

Annual Rate Shocks

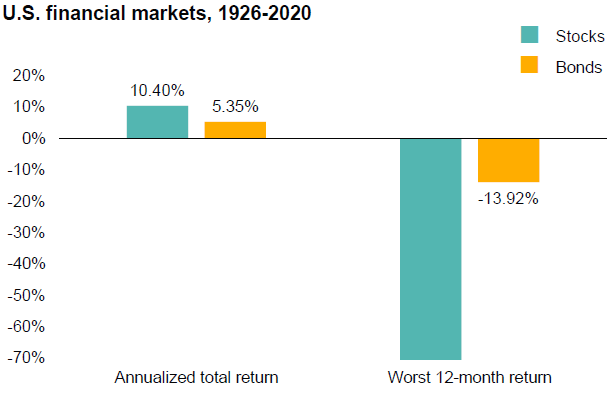

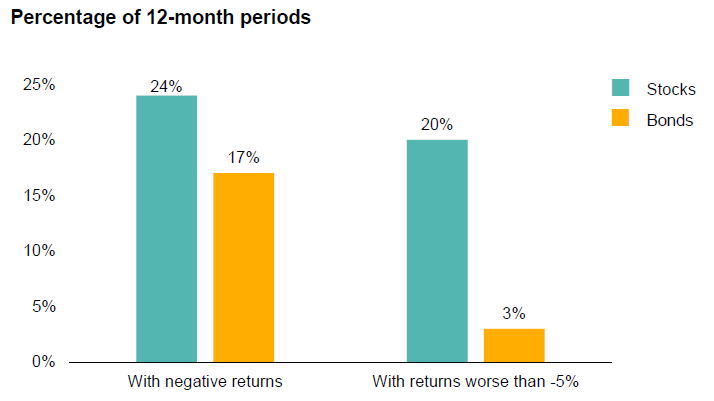

As the tables and graphic above show, rising rates are not catastrophic for bonds. The higher income that comes with rate increases helps offset damage down by principal hits. Down bond markets and down stock markets vary widely in magnitude and frequency.

Don’t let fear of the tiles not falling your way lead to bad decisions or avoidance of the game altogether. As with the stock market, investors must resist the urge to try to sidestep danger via market timing. The temptation with bonds and rising rates is to get out, “wait until it’s over,” and get back in. This could mean going to cash or concentrating exposure in short-duration bonds. Doing so may protect principal but could lower income if rates stay low.

Whether managing dominoes or duration, a strategy is critical. How is Trust Company of the South managing the risk to bond values from higher rates?

(1) Ensure that holdings match the time horizon – portfolios with short-term liquidity needs (< 6 months) are encouraged to utilize money market funds. These funds will hold their value and see yields increase as the Fed raises rates. Short-term bond funds, by contrast, will suffer price declines and have a deferred uptick in yield.

(2) Shorten duration – as noted above, there is risk in consolidating all bond holdings into short-term bonds. Acknowledging the low level of rates and their likely move upward, our portfolio’s duration is marginally shorter than the benchmark.

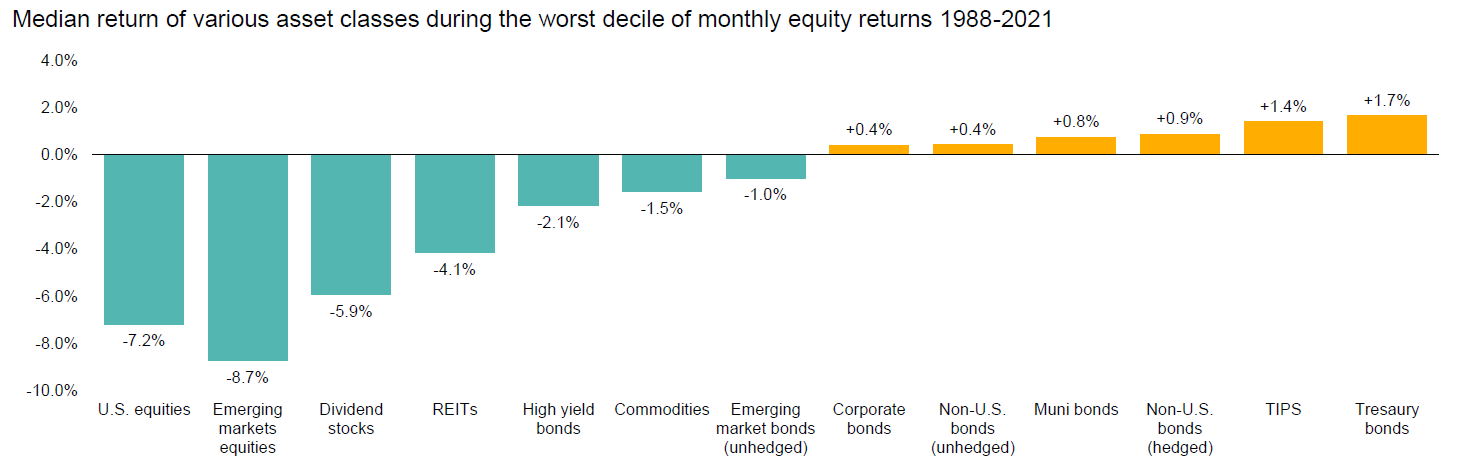

(3) Add credit exposure – bonds with higher yields are less sensitive to rate increases. Interest rate risk is exchanged for credit risk. Care is taken to keep the portfolio investment grade, which provides a ballast when the equity markets decline.

(4) Diversify within markets – holding bonds with maturities across the yield curve mitigates the risk of a rate increase in a particular maturity.

(5) Diversify across markets – international bond markets are influenced by local interest rate moves and inflation expectations. Such moves are not perfectly coordinated with the U.S. bond market. As a result, holding foreign bonds serves to hedge domestic interest rate risk.

The role that bonds play in a portfolio is to dampen volatility. For clients without the ability or willingness to tolerate volatility of an all-stock portfolio, bonds have a place in a long-term portfolio.

The best-designed waterfall of dominoes plays out perfectly in the creator’s mind. It seems so obvious that things will go exactly as planned and lead to an outcome where reality matches expectations. A mistake can quickly shatter that idyllic scenario. Similarly, making portfolio decisions based on perceived sure-things or consensus views feels comfortable at the time. It is only with perfect hindsight that it becomes clear what was off and why. Inflation, interest rates, and bond prices may all act as imagined. But, I wouldn’t count on it nor would I make a large wager on it. I’d get out the box of dominoes.

As Chief Investment Officer, Dan is responsible for developing Trust Company’s investment strategy and managing client portfolios.