With US value stocks experiencing one of the longest and largest periods of underperformance relative to US growth stocks, we consider whether the value premium will continue into the future and, if so, how best to position a stock portfolio to realize this premium.

Key Findings

- US value stocks have outperformed US growth stocks by 3.30% annualized since 1928.

- US value stocks have outperformed US growth stocks in 84% of all 10-year periods since 1928.

- Not since the Great Depression have US value stocks underperformed US growth stocks by a similar degree.

- A careful look at stock market history offers comparable time periods where the value premium was declared dead only to recover dramatically.

Introduction

Savvy shoppers know how to get the most for their money. If you could buy 10 apples for $1.00 or 15 apples for $1.25, what’s the better deal? It’s the latter, as the cost per unit (apples in this case) is lower. You don’t know in advance if one option will lead to a better result (taste). You assume the same outcome and look for the better deal. This is basically the value premium at work.

Markets are mostly efficient, which means that all relevant information is reflected in a stock’s price. As new data becomes available, investors digest it and move the price to a fair level. From a company’s exciting opportunities to its concerning threats, the price should reflect its prospects. Trying to outsmart the collective knowledge of global investors is not a game that is easily and consistently won.

If we assume that two stocks are priced fairly to reflect their possible futures, how do we decide which we prefer? First, as the future is unknowable, we don’t pick one. We own them both. But, we use the same approach as we did with apples to improve our odds. A valuation measure compares stocks using a common metric. For example, the price-to-book ratio compares two stocks’ price per unit of book value. Where is the better deal? Assuming the same outcome, the lower per unit price is the answer.

Why Do We Pursue the Value Premium?

A tenet of Trust Company of the South’s investment philosophy is to pursue compensated risks. In practice, this means to deviate from the market’s composition and hold stocks at different weights. By overweighting stocks with higher expected returns and underweighting names with lower expectations, the portfolio is positioned differently. This makes sense as, to outperform the market, the portfolio has to differ from the market. This deviation may or not payoff (the risk).

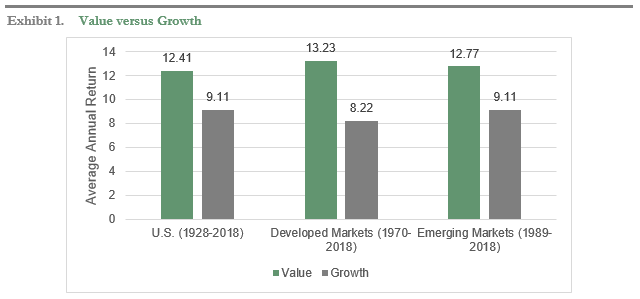

One of the sources of higher expected return is targeting stocks with lower valuations (aka “value” stocks) as described above. The value concept is not just theoretical. Looking at the longest available return data sets for the U.S., International Developed, and International Emerging markets, there is an observable return premium. Value stocks have bested growth stocks in these markets by annual averages of 3.30%, 5.01%, and 3.66%, respectively as shown in Exhibit 1.

Over long periods of time, the numbers are impressive but not constant nor guaranteed. I often explain to clients that if the value premium was available for the taking every year, it would not exist. Investors would pour money into value stocks and bid prices up to a point where the higher return disappeared. While we expect higher returns every day, we don’t realize them every day.

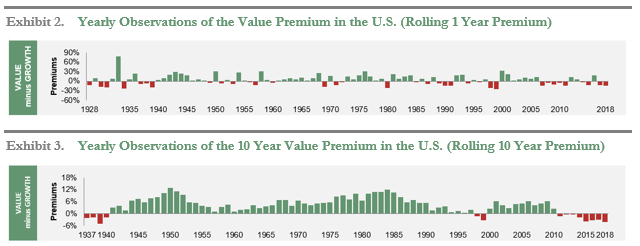

The exhibits below illustrate how the value premium is observable but less consistent on a year-to-year basis (Exhibit 2); however, over longer periods, the value premium increases in consistency (Exhibit 3).

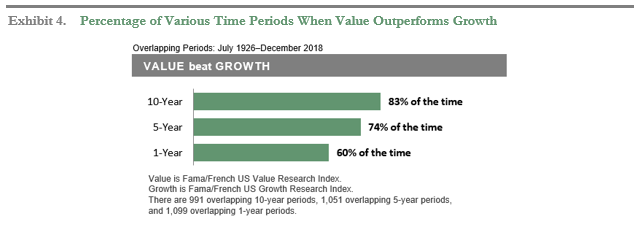

We cannot know when the value premium will appear, for how long, and to what extent. So, the best approach is to have a disciplined investment strategy. Historically, short-term pain (underperformance) has been rewarded with long-term gain (index beating returns after expenses) the majority of the time as illustrated in Exhibit 4.

Will the Value Premium Reappear Soon?

Recently, value has underperformed growth even for recent 10-year periods. This is not unexpected. It has happened before and will happen again. Despite the 83% success rate of value over growth, there is the other 16%. And things can change fast.

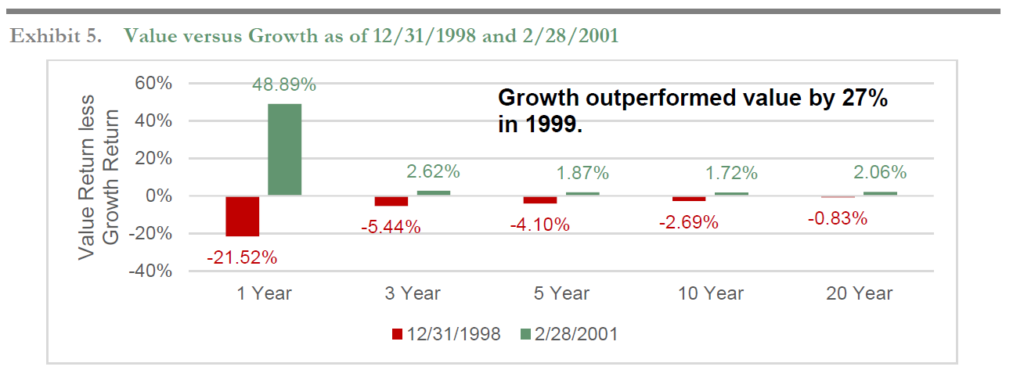

Consider year end 1998. Growth had bested value over 1, 3, 5, 10, and 20 year periods. Then came 1999 when growth beat value by 27%. Surely, the value premium was dead or at least not worth pursuing. By February 28, 2001, a mere 14 months later, value was beating growth over all of the aforementioned time periods.

Exhibit 5 below illustrates this dramatic reversal of value’s performance over growth’s performance around the time of the tech bubble.

Now, for argument’s sake, let’s assume there is no value premium going forward. How should a portfolio be invested? Growth stocks have outperformed value stocks. A basic investing axiom is to buy low and sell high. Rebalancing a portfolio would mean selling outperformers (growth) and buying underperformers (value).

A look at valuations, which are a good indicator of long-term returns, makes a similar case. Growth stocks are not only expensive relative to value stocks but relative to their own history. Selling expensive names and reinvesting in cheaper stocks increases the portfolio’s expected return.

Most of the comparisons so far have been value versus growth. The options are not mutually exclusive, though. A tilt toward value increases the potential gain, but it is not an “all-in” bet. A diversified fund with a low cost that leans toward value will produce a solid result even if the value premium ceases to exist.

What is the Best Way to Implement a Value Tilt?

Regardless of whether one is strategically pursuing the value premium or tactically positioning to reflect recent market moves and current valuations, what is the best method for investing in value? There are three main paths.

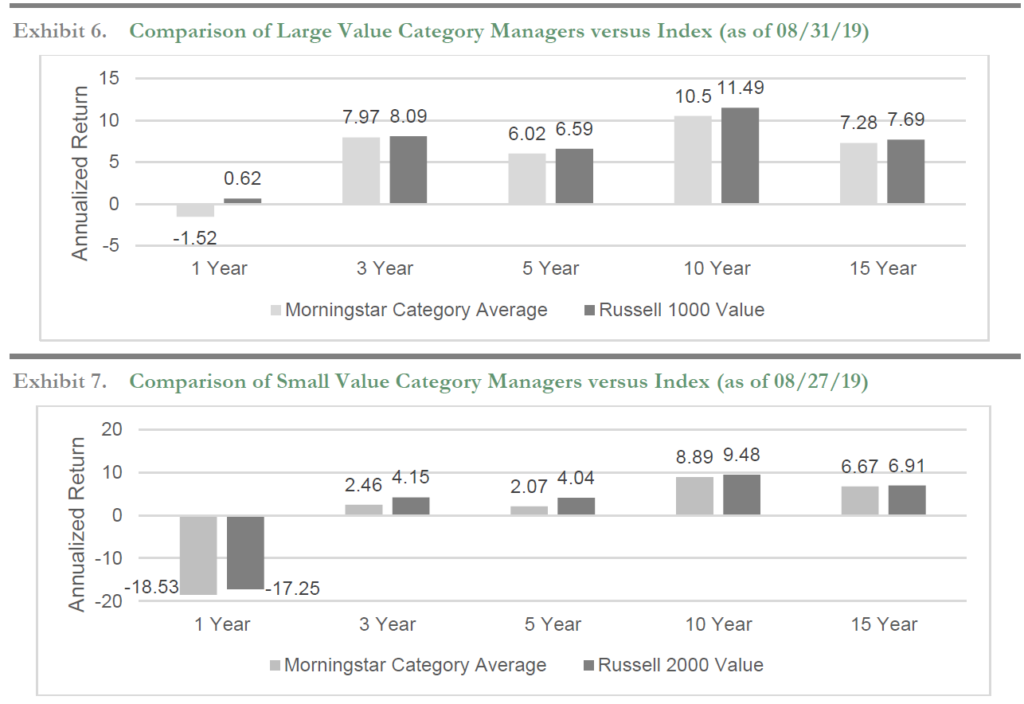

In the first, conventional active management attempts to provide benchmark-topping returns. The manager will try to outsmart other investors. As a result, there will be variance around the benchmark’s return. Some positive, some negative. Unfortunately, over long periods of time, there’s much more negative. This can be observed by looking at the Morningstar category average returns (Exhibits 6 & 7) for the large value and small value groupings.

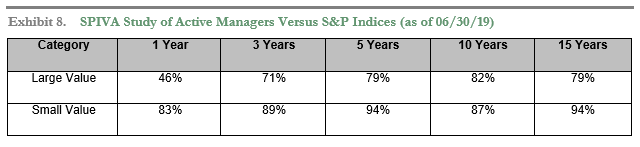

This is, unfortunately, a typical result for stock pickers trying to beat a benchmark. Standard & Poor’s Index Versus Active (SPIVA) study, which is produced semi-annually, shows the percentage of stock pickers that trailed their benchmarks as shown in Exhibit 8.

While these odds are bad, the story gets worse. You would have had to identify one of the minority of winners in advance. Picking a past winner is no guarantee of future success as a small number go on to repeat as victors. Lastly, “beating the benchmark” doesn’t capture magnitude. A return over the benchmark of, say, 2.00% sounds great. But, beating it by 0.01% also counts as outperformance!

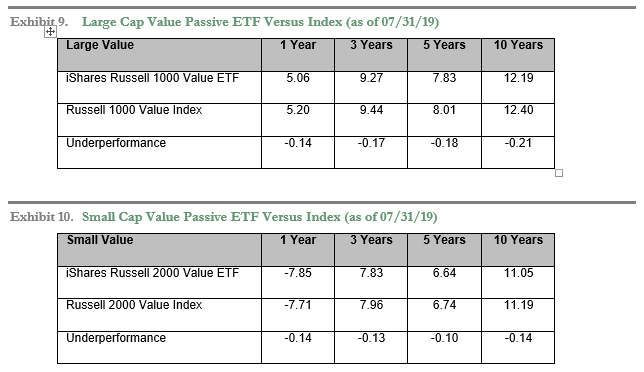

In the second approach to investing in value, index funds seek to minimize variations with the benchmark’s return. As such, there will be little difference between the fund’s return and its target. This predictability is nice, but it comes at a cost. Index funds will always trail the benchmark because of their expense ratio. Take, for example, two iShares funds as of 7/31/19 in Exhibits 9 and 10.

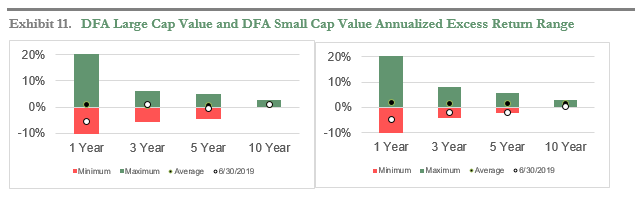

For the third method to value investing, an evidence-based approach uses research to construct a portfolio. Rather than try to outsmart the market, it harnesses the power of markets. Using the information reflected in where investors -in aggregate- have set prices, the portfolio can be structured to maximize return instead of minimizing noise around a benchmark.

Building a portfolio that is different than the market leads to returns that are not the same as the market. In shorter periods of time, this can be significant; however, the noise fades over time and the approach triumphs.

Over 1 year periods, DFA Large Cap Value has trailed its benchmark by as much as -10.5% and beat it by up to +20.3%. The range shrinks over time: 3 year periods (-5.8% to +6.2%), 5 years (-4.5% to + 5.2%), and 10 years (-0.4% to +2.7%).

The story is the same for DFA Small Cap Value. 1 year periods (-13.8% to +21.3%), 3 years (-4.3% to +8.2%), 5 years (-2.3% to +5.6%), and 10 years (-0.1% to +3.1%).

This information is displayed in Exhibit 11 below.

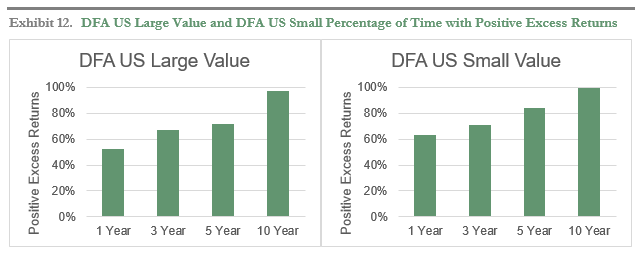

The odds of a benchmark-topping return (after fees) also increase with time as shown in Exhibit 12.

Conclusion

It has been frustrating to be a value investor as of late. However, whether it is apples or stocks, you receive more when you pay less. Short-term underperformance and noise around the benchmark are the costs for the benefit of higher long-term returns. History shows that the odds favor the value investor but there will be challenges along the way.

So, this fall, sit back and enjoy an apple. Current valuations point to better days ahead for value stocks. Having the gumption to stick to plan and capture these returns is critical. Peace of mind is further provided knowing that an evidence-based approach is the most probable road to success.